At the end of a glorious bull run towards another all-time high in November 2021, Bitcoin’s value took a blow which saw its price plummet to a low of $35,071.80 USD on January 23, 2022. While Bitcoin’s price has somewhat recovered and stabilized since then, this drop in value has understandably worried many Bitcoin holders.

What most people don’t know is that bear markets (like the one we’re at now) are not just survivable — they’re profitable. Let’s take a look at all the things you can do when Bitcoin is in a bear market.

Why is Bitcoin down?

Before we get into how to profit during a bear market, let’s first talk about why Bitcoin’s price is down in the first place. The root of it is that Bitcoin, similar to traditional fiat currencies, is still affected by current events and new regulations.

For example, in 2021 the Chinese government would declare an all-out ban on Bitcoin. This included trading, holding, and even mining BTC. The effect on BTC value was immediate, coming from $63, 569.81 USD on April 14 to $29,789.94 USD on July 21.

Another example would be when the fear of a “crypto winter” hit the community. This fear pulled BTC’s value down to a low of $35,071.80 USD from $50,792.04 USD.

In either case, BTC would find a way to recover, but that doesn’t make it any easier for any of us who’s invested in Bitcoin. Thankfully, we’ve got a few strategies available to help us not just survive, but thrive in a bear market.

Dos and don’ts of a Bitcoin bear market

To help make things easier for everyone to understand, we’ve come up with a short list of things you should and shouldn’t do during a Bitcoin bear market. Take note of them and see which ones fit your needs.

Don’t panic sell

The first thought that might pass through our minds might be to sell what we have. If you’re thinking of selling due to panic, we’re here to say that it would be better to take a step back. The problem with selling immediately after a price drop is that you are only realizing the losses that you’ve incurred when Bitcoin’s value went down. The answer to the question “should I sell my Bitcoin?” is a resounding no.

Do HODL

The ever-famous mantra that Bitcoin enthusiasts throw at each other during bear markets is actually rooted in sound logic. HODL, or hold on for dear life, is meant to be a battle cry for Bitcoin holders to stay put and weather the panic that’s affecting the rest of the market.

In simple terms, it follows the logic that if Bitcoin’s price used to be at a high point, it ought to find its way back after staying low for a period of time. It makes sense when we take a look at how Bitcoin’s value has consistently found a way to break its previous all-time highs after periods of extreme lows.

HODLing is a lot easier said than done, though, as some HODLers face extreme stress watching prices go down as they hold.

Don’t trade right away

Bear markets are notorious for being times of extreme emotional distress. This can cause more than a few traders and investors to start considering trading what little they have left just to minimize their losses.

The problem with this is similar to those that sell immediately after price drops. Fear, uncertainty, and doubt (also known as FUD) are to be avoided when trading Bitcoin. Decisions to trade or sell should be made with confidence, which often needs tangible information. Don’t let the fear of the community affect your trading!

Don’t focus on all-time highs

Bitcoin’s all-time highs show us that BTC’s value has been improving over the past decade, but the fact is that all-time highs aren’t its most stable points.

It’s easy to be blinded by the large numbers of all-time highs. The thing is, they don’t always stay. Just like bear markets, the extreme highs and lows of Bitcoin value are temporary points in its price history.

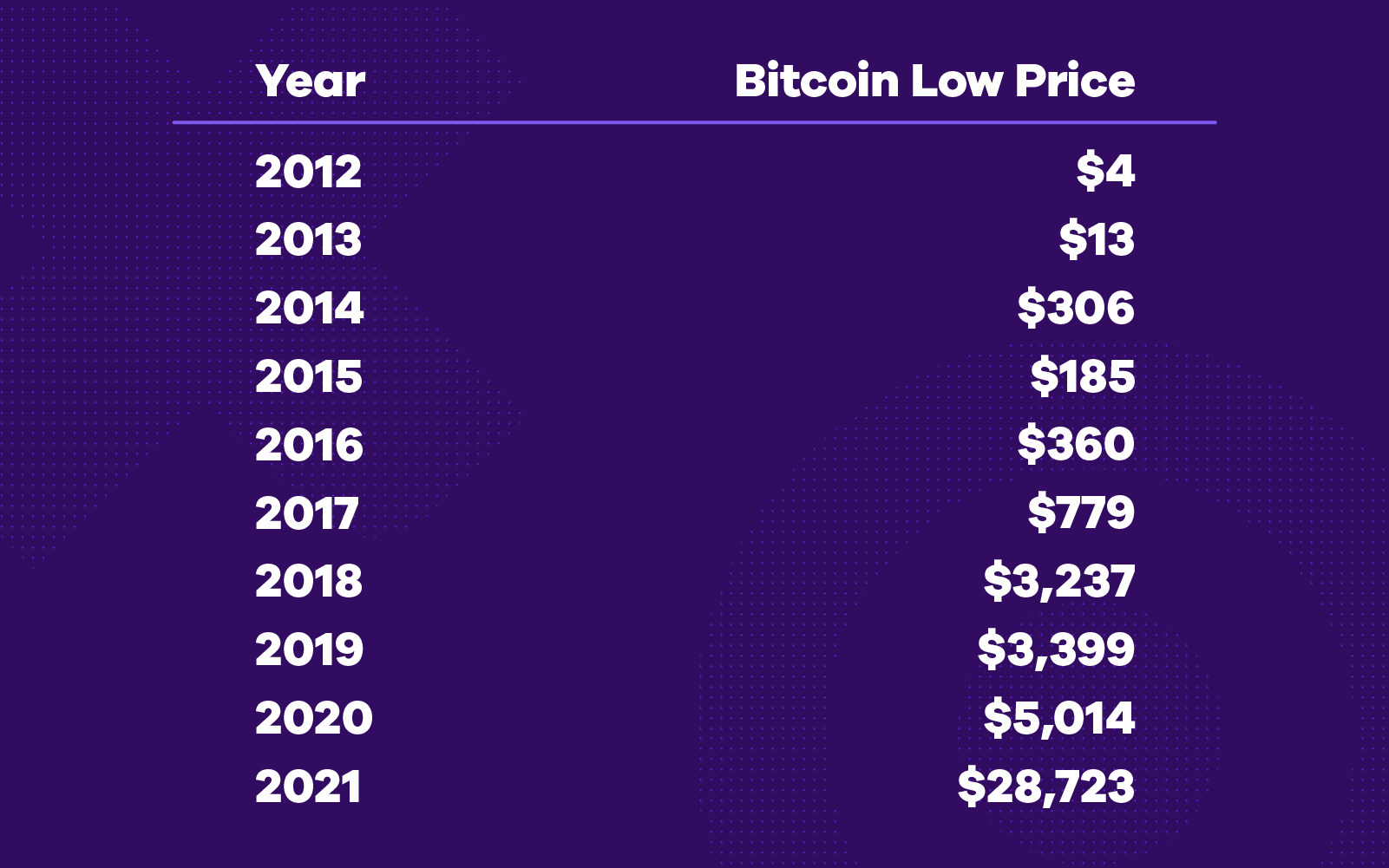

Do look at yearly lows

Instead of focusing on all-time highs, things would be better put into perspective if you do the opposite and take a look at yearly lows instead.

Zoom out and take a look at Bitcoin’s overall price history. Observe the yearly lows and compare them on a year-to-year basis. You might find that you’re in a better spot than you initially thought, which could make HODLing a lot easier.

Bitcoin bear market strategies you should try out

It’s like we said earlier—sometimes, a change of perspective is all you need. The most important thing to remember is that your Bitcoin trading and investing should be done with confidence. To give you an idea, here are a few strategies that may work for you:

HODL

HODLing has become a great strategy for those who don’t necessarily have the time to navigate through a bear market. It will have its own challenges and limitations but it has often helped traders weather the storm.

DCA

Dollar-cost averaging, or cost averaging for others, dictates a strategy where traders and investors buy BTC in increments over time. Say you had $1000 USD to spend; divide this into groups of $200 USD. Then, over the next few weeks, you only buy $200 USD worth of BTC each time.

What this does is it minimizes the potential loss you might incur if the price goes down after your initial investment while maximizing your potential gains once BTC value starts climbing back up.

Buy the dip

For traders and investors with a little extra cash ready to buy Bitcoin, you can take this time to take advantage of the situation. Of course, there is still that risk of Bitcoin’s price going down even more.

To counter this, what some investors do is follow traditional strategies like cost averaging techniques. This limits the amount of risk you face with each purchase, while also maximizing your potential gains once Bitcoin’s price finds its way up.

Bitcoin will always go back up

The bigger point here is that over the past decade, Bitcoin has proven that it’s here to stay. The value might dip for a while, but each time Bitcoin would find a way to recover and even reach new highs. So long as we keep ourselves well-informed, keep a close eye on the crypto fear and greed index, and continue to do our own research, we should find bear markets to be a little easier to deal with.

*The content of this article is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. You should do your own research and may want to seek professional advice before making any decisions.