Bitcoin has given a lot of reasons for people to believe in it—whether it be the real-use cases it has developed, the good that it’s doing for the world’s unbanked population, or simply for investment purposes. The public’s confidence in Bitcoin is one of the reasons why a single Bitcoin is valued at thousands of dollars.

Despite that, many people remain skeptical about where Bitcoin gets its value. To give you a better understanding, let’s break down where its price comes from.

Why do currencies have value?

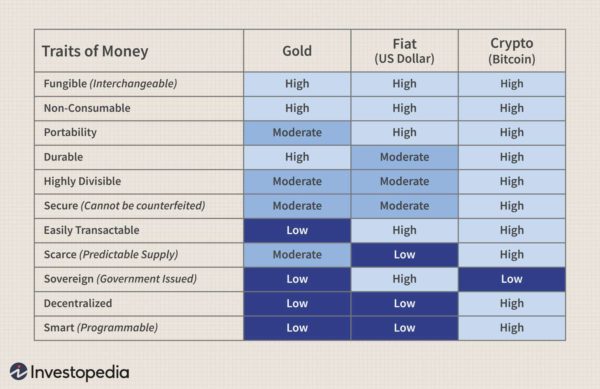

Before we dive into why and how Bitcoin is valued, let’s take a look at traditional currencies. Specifically, what makes the bills and coins in our pockets valuable? These are the six main characteristics of sound money:

- Scarcity – A currency will be devalued if there’s too much in circulation. To make sure purchasing power remains stable, it’ll need to have a limited supply.

- Divisibility – The currency needs to be divisible (e.g. US dollars into cents) so that it can be used for smaller purchases in your everyday life.

- Acceptability – Vendors and merchants need to accept your currency before you can spend on their goods and services.

- Portability – Your money needs to be easy to transport so that you can spend it when you need to. Bills and coins can be kept in wallets but something like gold can be a little more difficult to carry around, especially in large amounts.

- Durability – Money needs to pass the test of time, which is why food isn’t a good currency since they spoil and why gold is widely regarded as an excellent store of value.

- Resistance to counterfeiting – Bills and coins have special markings on them and are made out of materials that are extremely difficult to fake. Gold has special letter marks, certificates, hallmarks, and nitric acid tests to check its legitimacy.

More importantly, a currency will have value as long as the general public believes it so.

Why does Bitcoin have value?

Bitcoin has value because there are millions of people who believe in it. But how does Bitcoin stack up to the six characteristics mentioned above:

- Scarcity – Bitcoin was designed to have a limited supply of 21 million BTC as well as have deflationary precautions (e.g. the Bitcoin Halving) to keep its value.

- Divisibility – Bitcoin can be divided one hundred million times into a satoshi (0.00000001 BTC), allowing people to make smaller purchases with their BTC.

- Acceptability – As adoption grows and countries begin to accept it as legal tender (e.g. El Salvador), more people are starting to use Bitcoin for everyday purchases.

- Portability – With the many different kinds of Bitcoin wallets available, you can easily store your BTC on your laptop, tablet, smartphone, and even on a small physical device that’ll easily fit in your pocket.

- Durability – Bitcoin has no physical form, so it’s automatically resistant to things like decay or damage from natural disasters.

- Resistance to counterfeiting – With the power of the blockchain behind it, Bitcoin is incredibly difficult, if not impossible, to counterfeit. To do so, you’d need all the computing power in the world to hack the network.

Bitcoin is valued today as a commodity because many people and financial institutions realized that its scarcity is similar to precious metals. As adoption becomes more widespread, Bitcoin has the potential to be a deflationary currency similar to the US Dollar when it was under the Gold Standard.

What influences the price of Bitcoin?

With it passing all six criteria of being sound money, let’s now talk about why Bitcoin’s value fluctuates—which can be boiled down into four factors:

Cost of production

Bitcoin mining is a process where miners verify Bitcoin transactions and add them to the blockchain. For that, they’re rewarded with newly-minted BTC. Often, miners will use a vast amount of electricity, which influences Bitcoin’s value.

On average, a single block will take 10 minutes to verify. As more miners join, competition increases, which will make verifying these transactions more difficult. When that happens, solving it can cost miners more, especially if they’re looking to preserve that 10-minute interval.

Supply and demand

Like other commodities, the value of Bitcoin is affected by the law of supply and demand. The more people want Bitcoin, the higher the price. If large amounts of Bitcoin are readily available in the market, the lower its price.

Why the demand for Bitcoin changes is discussed in a separate article but two key features of Bitcoin heavily affect its supply:

- The rate at which new Bitcoin is created

The blockchain’s protocol allows Bitcoin to be minted at a fixed rate. When Bitcoin transactions are processed and validated, new Bitcoin is created and introduced to the market. This process slows over time because of Bitcoin Halving, which can lead to scenarios in which the demand for BTC rises faster than the supply, therefore, driving the price up. - Bitcoin’s supply cap

Satoshi Nakamoto designed Bitcoin to have a cap of 21 million BTC. Once that cap is reached, miners will no longer be rewarded with new BTC. What will drive Bitcoin’s value in the future is the supply of Bitcoin in active circulation.

Bitcoin’s competition

Despite Bitcoin being the most recognized cryptocurrency on the market, there are thousands of other cryptocurrencies out there trying to fight for our attention. As such, Bitcoin’s dominance directly affects its value.

The crowded space may allow for more diversity in an investment portfolio but because of its competition, Bitcoin’s value can stay grounded. If Bitcoin were the only cryptocurrency on the market, its price could look totally different.

Government regulations

Because Bitcoin is still a relatively new form of asset, regulators are still figuring out how to classify it, which makes it difficult for governments to adopt a position. They’re constantly changing regulations such as taxation, AML (anti-money laundering) rules, among other things.

Although Bitcoin is decentralized and isn’t tied to a specific government, regulations can still directly impact Bitcoin’s value because they apply to investors. Regulations imposed on Bitcoin vastly differ depending on how a country views it. But if there’s a fear about a particular government statement or decision, it could cause Bitcoin’s price to fall.

Price shouldn’t matter

Despite people getting into the Bitcoin space purely for investment purposes, many people have decided to use it as everyday money—something they can hold or use out in the world for real goods and services.

If you’re using Bitcoin the way Satoshi Nakamoto intended—as a means of transaction, store of value, remittance, and more—price shouldn’t matter as much to you as it does to those just looking to make a quick buck.