Knowing the best time to buy crypto isn’t always easy. Since these assets are highly volatile, little to extreme price changes can happen at any moment. This is the very reason why some folks experience FOMO or the fear of missing out.

FOMO is the feeling one experiences when the price of cryptos like Bitcoin (BTC) suddenly moves in extreme directions. When the price of crypto declines, many people tend to go into a state of panic-selling because they fear losing more money. This all-consuming feeling is also evident when crypto value shoots up, as many think they don’t have enough coins to hold or sell.

The reality here shows how undeniably tricky it is to decide when to dip your toes into the crypto waters. However, if you’re looking for a way to grab financial opportunities from digital currencies in the long run without worrying about every market movement, you might want to consider trying the dollar-cost averaging (DCA) strategy. But before you get started, what even is dollar-cost averaging and how does it work in the crypto space? Let’s dive into it.

What is dollar-cost averaging?

Dollar-cost averaging, also known as constant dollar plan, is a strategy where you invest the total sum of money in small increments for a specific period. This would be the opposite of handing out a lump sum in one go. In this approach, your purchases will go through recurrently, regardless of the asset’s price or the market movements.

This strategy is very popular for investors looking to back certain assets, such as commodities, crypto, stocks, and more, for the long term.

How does DCA work in crypto?

The first thing you need to do is decide how much crypto you wish to invest. In typical investments, you hand off the entire amount of money you’re willing to invest in a particular asset. But with dollar-cost averaging, you invest a fixed amount of United States dollar (USD) into BTC or any crypto of your choice over a certain period. A simple example of this would be buying 15 USD worth of BTC every week for a year.

It’s important to note that choosing which cryptocurrency to use in DCA is crucial. Currently, there are over 12,000 cryptocurrencies available on the market. The dollar-cost averaging strategy will run for a lengthy period, so picking a coin that you believe will grow after some time will help you get the most out of your time and money.

Here’s another example to help you better understand how the dollar-cost strategy works:

Let’s say it’s January 2020 and Claude decided to buy 1,020 USD worth of BTC. At that time, Bitcoin was selling for around 7,100 USD per coin. Instead of using the entire amount to make a bulk purchase, Claude opts to try dollar-cost averaging Bitcoin for 12 months.

Each month from January 2020 to December 2020, Claude consistently bought 85 USD worth of BTC—regardless of the spikes and dips in the market. After an entire year, this is what his earnings look like:

Source: dcabtc.com

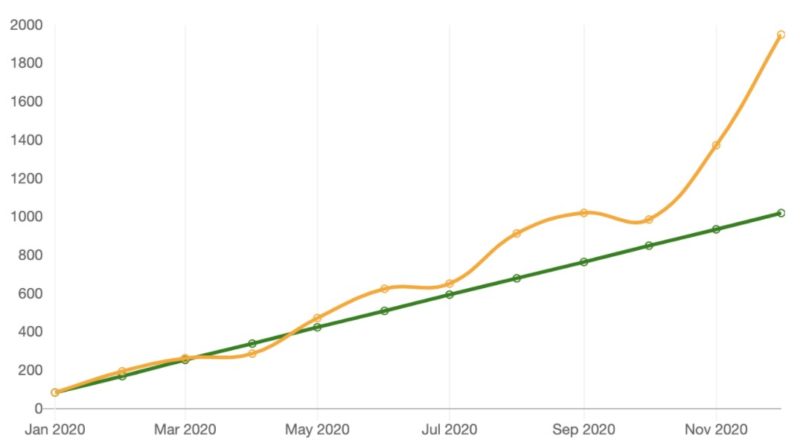

Portfolio Value Over Time

The green line in the graph above represents the total amount that Claude invested. The orange line, on the other hand, indicates the movement of BTC’s value during the investment span of 12 months. At the beginning of Claude’s investment, the value of BTC and the amount he put in were in the same range—both were worth 85 USD. However, as months passed by, Bitcoin’s price started to move in different directions.

At the end of the year, Claude’s investment of 1,020 USD in BTC saw a staggering growth rate of 91.19% or a total value of 1,950 USD worth of BTC.

The tool used to calculate the potential value of Claude’s earnings used the historical price of BTC as a reference. This helps determine the number of satoshis—or small amounts of BTC—he would have acquired at that time.

You can also check out DCA tools online to see how much earnings you can make after months of constantly buying Bitcoin. The dcaBTC tool, for example, allows you to customize your DCA settings and set the amount you want to buy, the frequency of your payment, and the duration of your investment.

The benefits and drawbacks of dollar-cost averaging

Like any new engagement in the crypto world, the dollar-cost averaging strategy also comes with a couple of pros and cons. Here are some of the things you need to know before you begin your DCA plan.

Let’s start with the pros of dollar-cost averaging. Since you’re choosing to make constant and equal purchases for a certain period, you can save yourself from the potential mistake of making one lump-sum investment that isn’t thought through. And because your purchases are scheduled, you can steer away from FOMO and avoid making snap investment decisions out of emotions—worrying about sudden price swings will no longer be your thing.

Crypto exchanges and marketplaces charge fees for every transaction you make. While this might sound like you’re going to pay more trading fees with DCA, keep in mind that the dollar-cost averaging strategy is a long-term plan. The fees you pay are negligible compared to the earnings you’ll potentially gain after a few years.

Apart from that, you won’t need massive amounts of capital to get started with DCA. Since this approach is about making small and constant purchases, you won’t have to worry about handing out a huge amount of money in one go. You can also get a hold of crypto at lower prices, should there be any dips or crashes in the market by the time you buy.

On the flip side, you may also experience buying crypto at higher prices if the value shoots up on your scheduled date of purchase. This is especially true when BTC or the crypto of your choice is in a strong bull market. Many crypto enthusiasts and investors often choose to make a single bulk purchase because of the fear that the price would go even higher in the coming hours, days, weeks, or even months.

We’ve also mentioned earlier that you’re buying small amounts at scheduled times for a certain period in the DCA strategy. This means that you will purchase fractions of crypto whether the market is stable, shooting up, or jumping down.

Is the dollar-cost averaging strategy worth trying?

DCA aims to help you get the most out of your crypto without risking too much at any given time. While this approach comes with some disadvantages, it also lays out many benefits that you can potentially enjoy along the way.

So, is dollar-cost averaging with crypto worth your time and money? As always, do your research, explore what else it can offer, and start from there. You can also bookmark this article on your browser to keep the information handy whenever you need it. Good luck!

* The content is for informational purposes only. You should not construe any such information or other material as legal, tax, investment, financial, or other advice. A qualified professional should be consulted prior to making financial decisions.