It’s been a great decade for Bitcoin, with more and more people accepting its use and believing in its goal of financial inclusion and empowerment. What we have to remember about Bitcoin, though, is that there is a limit to its supply and the rate we approach that limit. Its developers achieved this by introducing us to Bitcoin halving, or what’s known as “the halvening” in some circles.

What is the Bitcoin halving?

New Bitcoin is minted and rewarded to people who verify transactions on the Bitcoin blockchain. The amount of Bitcoin minted is reduced by half after 210,000 transactions (roughly every four years), hence the name.

When Bitcoin was first introduced, miners were able to claim a 50 BTC reward for each block they helped verify. In 2012, the reward was cut to 25 BTC, 12.5 BTC in 2016, and 6.25 BTC in 2020. Bitcoin halving in 2024 will cut the reward to just 3.125 BTC for every block of transactions added. This Bitcoin halving cycle will continue until we reach the 21 million Bitcoin limit.

Bullish effect on the market

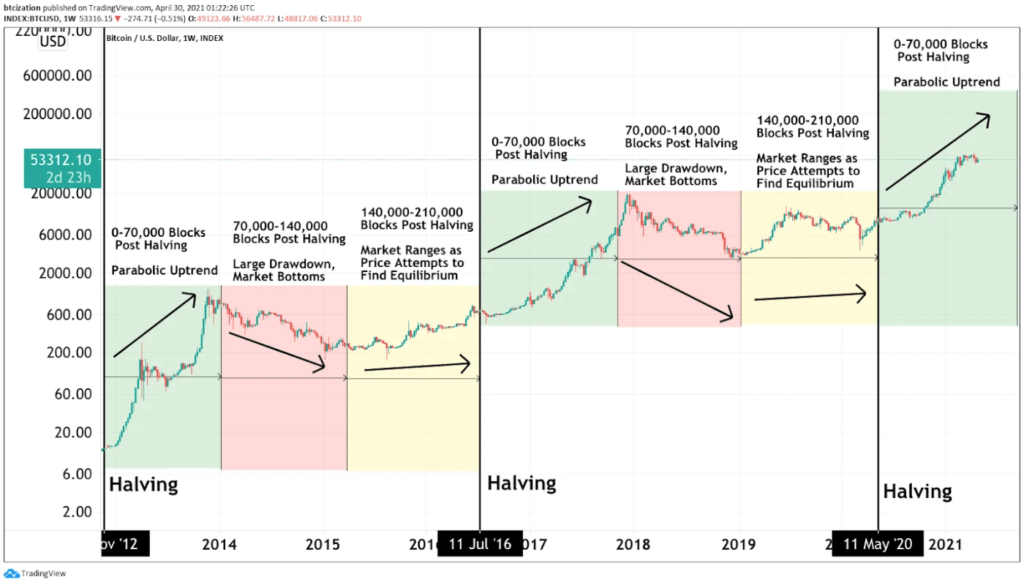

We would see a pattern emerge with each Bitcoin halving. In 2016, the BTC value was at 665 USD before the halving, reaching 2,250 USD a year later. 2020s halving would happen earlier in the year, in May. By the end of that same year, BTC would reach a price of 29,000 USD—the highest it would get that year. At this point, it’s safe to assume a bull run follows every Bitcoin halving cycle.

Source: Bitcoin Magazine

Why do bull runs follow every cycle? Bitcoin was created based on the law of supply and demand. The supply of new Bitcoin is gradually reduced with each Bitcoin halving cycle. Low supply generally means a higher price.

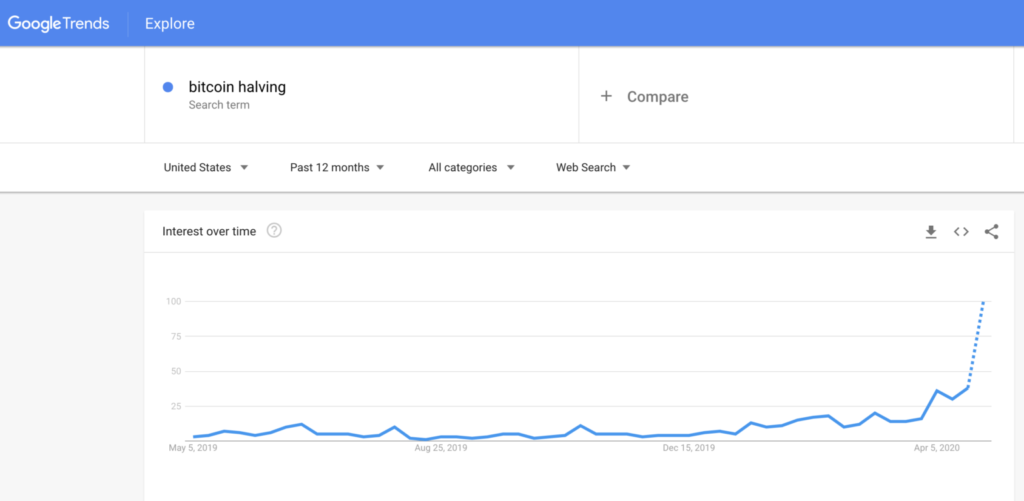

There also seems to be a lot of buzz just before the scheduled Bitcoin halving date. Google Trends data showed that the number of people searching for ‘Bitcoin halving’ spiked tremendously leading up to the 2020 Bitcoin halving cycle:

Combine low supply with record-level demand and you may have the perfect recipe for all-time-high Bitcoin prices.

The bearish part of the cycle

While it’s nice to think of the Bitcoin halving cycle as an instant way to pump Bitcoin’s value, we have to bear in mind that it’s only temporary. The market will always correct itself when the buying frenzy cools down.

Source: Cointelegraph

Historical data shows that bear conditions that can last around 12 months follow after a bull run. Bitcoin’s value would normally be much lower, only starting its upward climb again a few months before the next Bitcoin halving cycle.

What does this tell us about the current market? Simply put, it looks like we’re right we’re supposed to be. With the next Bitcoin halving two years away, it’s no surprise that the market is behaving itself the same way that it has in the past.

Why is the current Bitcoin halving cycle more bearish than before?

The Bitcoin Fear and Greed Index functions as a social thermometer that we can use to gauge the community’s state of mind. Higher greed will manifest as buying sprees, while high fear would have users offloading their assets.

Currently, the Index will show us a reading of Extreme Fear. That’s no surprise with all the talk we might have seen in forums and how certain speculators are behaving. Fear, uncertainty, and doubt (FUD) from these factors could be making the current Bitcoin halving cycle more bearish.

Excessive money printing

Recently, we’ve had the opportunity to discuss quantitative easing and how it affects the Bitcoin market. While the goal may be to balance and invigorate the economy, news that QE is coming to an end has led market speculators to worry.

US interest rate hikes

In addition to the previous point, the U.S. Federal Reserve has called for the need to raise interest rates much more quickly than people had anticipated. The aim here is to reduce the cash generated from QE, with officials not only asking for a faster rate increase but a higher interest rate as well.

With higher interest rates, borrowing money today will be tougher and homeowners with variable mortgages will pay more for their loans.

Inflation

Global inflation rates caused by overabundance of cash may also be a factor here. In May 2022, the annual inflation rate in the US, for example, would accelerate to 8.6%, its highest since December 1981. This is manifesting itself as energy prices rocket (34.6%), food (10.1%), and shelter (5.5%).

High inflation and rising interest rates mean that the buying power of the public has weakened. For regular folks like us, the money we have will be spent on necessities while less cash is spent on investments like Bitcoin or stocks.

UST stablecoin fiasco

As a stablecoin, Terra was meant to provide users with a cryptocurrency that they can use to store their money without fearing volatility. In a surprising turn of events, stablecoin Terra’s value plummeted to almost 0 USD this year.

One thing to note here is that Terra uses an algorithmic stablecoin model, unlike Tether, which backs its tokens with fiat currencies held by real banks.

To complicate matters, Terra was sitting on billions of dollars worth of Bitcoin and caused investors to worry that the project would sell its reserves and flood the market with Bitcoin. Combine that with the fact that Terra’s collapse eroded some trust in cryptocurrencies, Bitcoin price at the time plummeted.

Where do we go from here?

The current mood in the market is, understandably, a little on edge. We’ve seen it shown on the Fear and Greed Index and we hear it from all the naysayers—what they both fail to consider though are the patterns that the market has been following.

Barring major events, Bitcoin will trend sideways until the next halving in 2024. But don’t worry, there’s light at the end of the tunnel. Another bull run is likely bound to happen if we take the previous Bitcoin halving cycles into account.

What we should take note of at this time is to only invest what we can afford to lose, and that there’s always a risk whenever we invest. It won’t do us any good to jump into the market just because we see a low price. The best way to go about anything is to make sure we’re well-informed, both about the product and the market we’re trying to enter. Luckily enough, the popularity of the blockchain means that there are a ton of resources out there that can help a beginner out.

As a currency, we have a lot to learn about Bitcoin. Thirteen years isn’t enough for the currency to mature, what more for us to learn everything we can about it. Fortunately, from what we’ve seen in the past, Bitcoin isn’t done yet.

From solely being an investment tool, Bitcoin has become one of the most practical options for people with limited access to traditional financial institutions. It’s been used for fundraisers and remittances and, in recent years, for transactions as simple as buying a cup of coffee. It goes without saying that Bitcoin is well on its way to achieving its potential, all that remains to be seen is how we, the market, take advantage of it.

*The content of this article is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.