In a surprising turn of events, Bitcoin enthusiasts are finding themselves in a market that is running in the same direction as the stock market. When Bitcoin introduced us to the idea of decentralized finance, a lot of us understood it to mean that the market would be as isolated as possible from traditional financial institutions. With what we’re seeing today, many of us are left, understandably, confused.

What is inflation?

Before we talk about how the Bitcoin market is impacted by it, let’s first define what inflation is. Inflation is what we call the rate at which prices rise over time. Generally, discussions about inflation talk about the effects of inflation in terms of the rise in the cost of living or in the general price increase of goods and commodities.

In and of itself, inflation is not necessarily a bad thing. In certain amounts, it can even be said that it can be beneficial for the economy. The problem begins when inflation runs out of control, potentially pushing the market into a state of hyperinflation.

Now, decentralized finance should be immune to these changes since it works on the idea of a totally separate system. Over the past few weeks, though, people have noticed a drastic change in Bitcoin’s value—a change that coincides with the rapid inflation we’ve seen with traditional financial institutions.

Effect of inflation on Bitcoin’s price

So what is inflation’s effect on Bitcoin’s price? On the surface, it seems that Bitcoin trends the same way as the current stock market conditions.

As Bitcoin became more widespread over the past couple of years, hedge funds, banking institutions, and venture capitalists bought vast amounts of Bitcoin as an investment vehicle—betting that they could turn a major profit by hoarding it.

Remember that since Bitcoin is a riskier asset than stocks or bonds, it is usually one of the first to be sold off whenever there’s uncertainty. In late 2021, Bitcoin whales started selling their hoard due to fear of inflation from excessive money printing from quantitative easing (QE). Bitcoin then flooded the market and eventually led to fear and uncertainty in the community, causing others to panic sell and the price to drop significantly. We’re seeing the same scenario on Wall Street, with high to moderate-risk stocks being sold off by investors.

Effect on Bitcoin speculators

Bitcoin speculators will have to be the most heavily affected party in this situation. With the market moving the way it is, speculators have started transferring their funds to stable coins in fear of a crash.

It’s similar to what we mentioned earlier about Bitcoin’s price. With so much uncertainty revolving around inflation, people have started selling their Bitcoin, snowballing to the point where Bitcoin’s value reflects these changes. Speculators are influential in the community, and their actions have a high chance of influencing the behavior of others.

Effect on Bitcoin hardware wallets and mining GPUs

With prices on the rise, the semiconductor shortage surely hasn’t helped with the inflation we’re experiencing now. This manifests in an increase in the price of Bitcoin hardware wallets since supplies are limited.

As an extension of that shortage issue we’re seeing with hardware wallets, the components used by Bitcoin miners are similarly becoming more expensive and harder to find. The shortage of mining GPUs will definitely hinder the operations of Bitcoin miners, particularly the new ones who have yet to establish themselves.

Effect on actual Bitcoin users

What won’t change is the fact that people still send remittances using Bitcoin. After all, the money you send will still be the same after fees. This makes remittances processed with Bitcoin the better option for anyone without bank accounts who send money abroad.

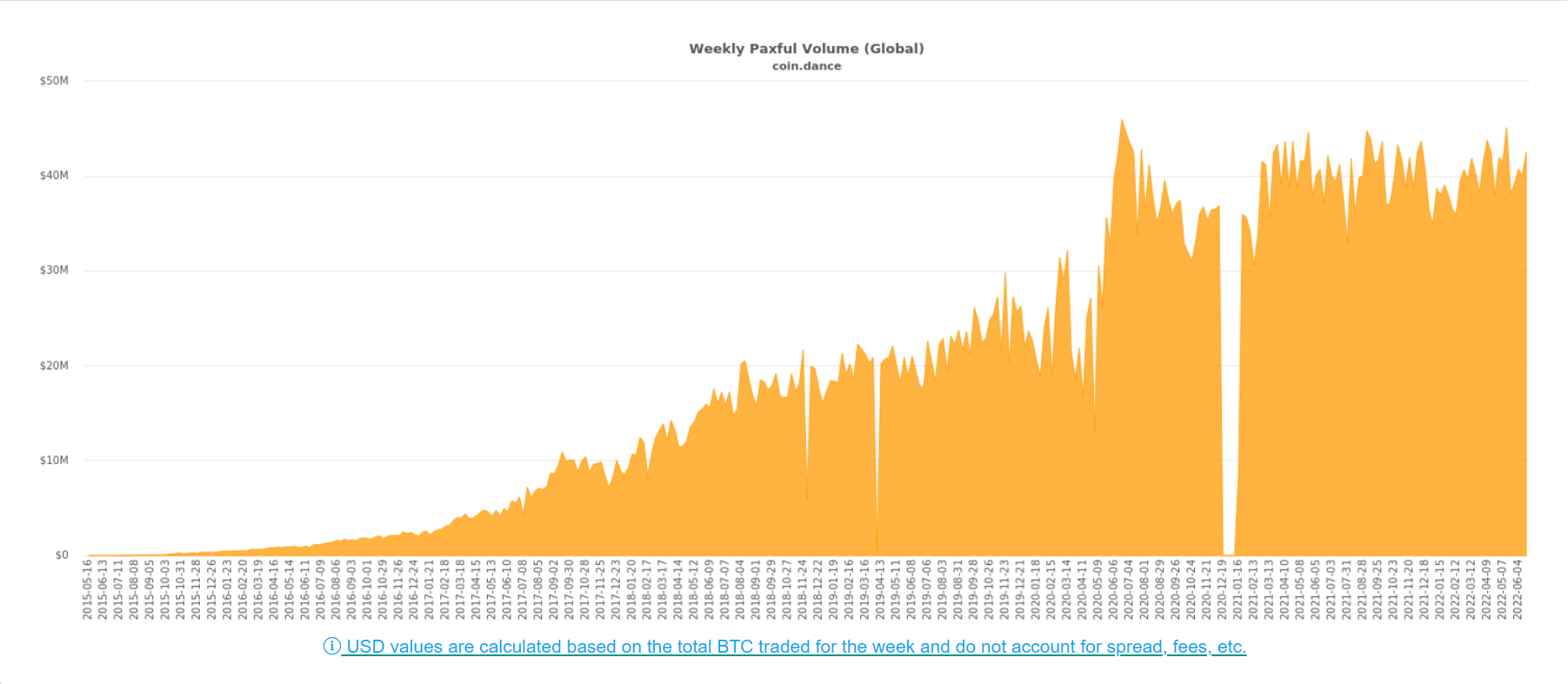

Let’s not forget, there are also those that still trade Bitcoin for a living. Trade volume on Paxful hasn’t seen drastic fluctuations at this time, showing us that users are still actively participating in the market. This is the opposite of what you’d expect if Bitcoin is crashing—it’s easy to spread fear and uncertainty during bear markets, after all.

Paxful weekly trading volume (June 2022)

Source: Coin Dance

Another thing to point out is that people are still hedging against inflation using Bitcoin. Despite all that’s happened to the market, Bitcoin users still find the blockchain a safer option to store their money. Inflation or not, 1 BTC still equals 1 BTC in the minds of true Bitcoin believers.

What are we missing?

Inflation might not be the only factor that plays a hand in determining the current price of Bitcoin. Rather, it could be one among many that have all coincided with a compounding effect.

Take, for example, the recent spate of government policies aiming to regulate Bitcoin and all the other cryptocurrencies. For each announcement by a government agency, the market would see a flurry of activity as people worry about how these policies might affect the blockchain.

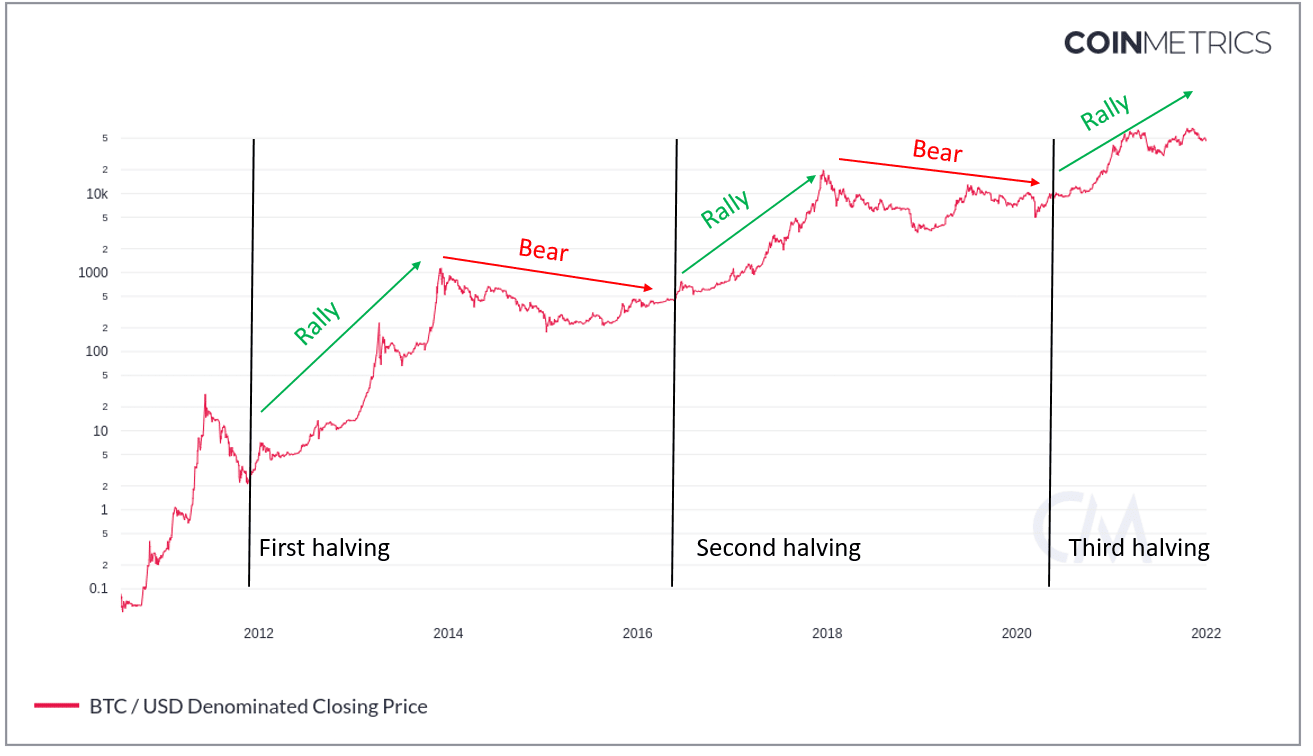

Another potential reason is the Bitcoin halving cycle — specifically, where we are in the cycle at the moment. Historically, there’s a bear market that lasts up to two years in between Bitcoin halving cycles. The public is less interested in Bitcoin during this period, and the price tends to trade sideways.

Bitcoin halving cycle chart

Source: Coin Metrics

Another possible culprit could be tax season. Some have noticed that Bitcoin’s value tends to underperform during the earlier part of the year (i.e., tax season). One explanation could be that this is caused by the number of users who sell assets to pay for their taxes come tax season.

The point is, it’s difficult to be too definitive right now. After all, Bitcoin itself is still a young currency. What’s best at this time is to learn as much as we can about it and participate in the community, taking care to do our own research.

Bitcoin is here to stay

We’ve come a long way since Bitcoin was first developed, and the lows the market is seeing right now are nowhere near what they used to be. In fact, you’ll even see that Bitcoin’s all-time lows (i.e., the lowest price it could go) are still trending upwards. All this is to say that Bitcoin is not dead.

That said, staying calm throughout all this is a challenge in itself. At the end of the day, it’s about making sure your money is safe, and it doesn’t lose its value. Inflation can’t be avoided, at least for now—the best we can do is get ahead of it. Decentralized finance may not be as mature as we’d like it to be but it’s already shown us what’s possible when you empower users from all over the world.