When it comes to Bitcoin trading, what users appreciate most is having a tool handy to help them make decisions. We’ve got tools like the Fear and Greed Index to help us decide, and this time around, we’ll be taking a closer look at Bitcoin’s dominance ratio to see how it can help with your trades.

What is Bitcoin dominance?

Bitcoin dominance is the measurement of the total market capitalization of Bitcoin in relation to the market capitalization of cryptocurrencies as a whole. In other words, it’s how present Bitcoin is in the cryptocurrency market. We can get the dominance ratio of Bitcoin through this formula:

Bitcoin dominance ratio = Bitcoin market cap/Total cryptocurrency market cap

The reason that this is important is that it can give you an idea of which currencies are currently utilized and to what extent. For example, if we were to look at Bitcoin’s dominance back in 2009, you would have seen a 100% dominance—that’s easy to understand since Bitcoin was the only cryptocurrency at the time. Over time, that 100% would decrease as more and more cryptocurrencies are introduced. Bitcoin dominance would reach 46% in June 2022, the highest its been since its 41% last October 2021.

Over its lifetime, Bitcoin’s share in the total market cap of cryptocurrencies is consistently the majority. We can point this to the fact that Bitcoin was the first, but we can also look at its level of adoption and utilization as significant factors with Bitcoin dominance.

What affects Bitcoin dominance?

As we’ve mentioned above, Bitcoin’s dominance is a ratio of Bitcoin’s market cap and cryptocurrency market cap. That means that, for the most part, Bitcoin’s dominance is affected by two main things—Bitcoin and altcoin value.

Bitcoin value

It stands to reason that Bitcoin’s value would play a big part in this. It should be clarified, though, that when we talk about Bitcoin’s value here, we are talking about its movement as well. That includes the reasons Bitcoin’s value may have dropped or increased.

Let’s take Bitcoin’s early days as an example again. Before the increase in altcoin options, Bitcoin was steadily in the 95% and above dominance. As more and more altcoins joined the market, Bitcoin’s value would increase but would also lose some dominance. At its lowest point, Bitcoin dominance would hit 35%.

Many people pointed out the fact that it was around this time (2017) that initial coin offerings (ICOs) gained popularity. This would imply that the market simply diverted more attention (and funds) towards buying altcoins in these ICOs. As more time passed, many of these altcoins would cease to exist or lose so much value as to be irrelevant—resulting in an increase in BTC dominance once again.

Altcoin value

In the same way, the altcoin value movement will affect Bitcoin’s dominance ratio since this will be what Bitcoin will be measured against. As altcoin performance and movement improve, Bitcoin will begin to lose its position in the market.

While it may seem that altcoins were in the process of dominating a more significant portion of the market just a few years ago, this current crypto winter is proof that initial performance is not necessarily indicative of long-term performance. This has also gone on to weed out pump-and-dump schemes as the sudden fluctuations exposed developers with bad intentions. An unfortunate side effect of all this is the fact that many users who relied on these altcoins lost a lot of their capital.

That’s not to say that altcoins, in general, are wrong—more, altcoins just aren’t as established and adopted as Bitcoin. Currency utility remains to be a big part of what makes a cryptocurrency successful, and as long as altcoins remain limited in their use, they will find a more challenging time creating a foothold in the market.

Bitcoin dominance chart

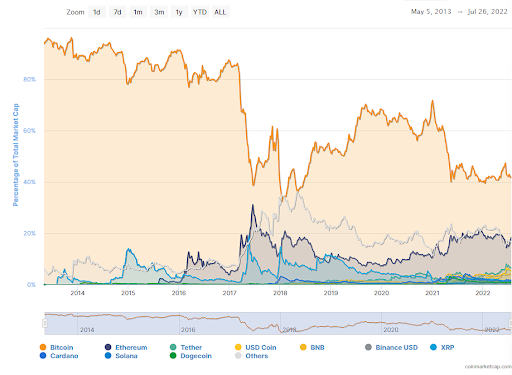

To give you a better understanding of how BTC dominance is represented, here’s a chart that can help visualize cryptocurrency market shares:

Source: https://coinmarketcap.com/charts/

Through this chart, we can get an overhead view of Bitcoin and all the other cryptocurrencies over the years and how well they’ve performed. Notice how Bitcoin’s dominance in 2014 steadily waned as more and more altcoins were introduced. Despite that, Bitcoin would retain the majority of the market, persisting through fearful and uncertain markets.

Should you rely on Bitcoin dominance when trading?

What we have to emphasize, after all that, is that Bitcoin’s dominance ratio isn’t a one-size-fits-all answer to many of our trading questions. At its core, the dominance ratio is simply a tool that users can use to make educated decisions. It’s similar to the Fear and Greed Index in that it is simply a meter that shows how the market is currently behaving and how it perceives Bitcoin or altcoins.

As far as tools go, the dominance ratio remains to be one of the most important. It provides a good description of market behavior and attitude and does so in a way that’s easy to understand for most people.

Despite how valuable a tool may be, though, practical research is still more important. Tools are just that; tools for our use. If we ourselves aren’t informed or educated enough, even the best tools will be hard to use or ineffective.

Utilizing all the available tools

At the end of the day, the most important thing for the Bitcoin community is that they’re made aware of all the available tools that are available to them and provide a good description of their best use. With the proper education and information, it’ll be easier for you to avoid making rash decisions.

But that does carry with it the prerequisite of doing your own research first. If you can imagine it, a lot of Bitcoin traders get by just by studying the markets without the use of these tools. Give yourself the advantage by learning what you can and making that knowledge much more effective by using what’s available to you.