Over the past few years, Bitcoin has been steadily gaining traction not only in financial markets, but also in overall adoption. But while more people own Bitcoin (BTC) than ever before, it hasn’t reached everyone just yet.

To get to the level of widespread Bitcoin adoption we’re all looking forward to, there are specific factors that have to be considered. Before we get into what needs to be done for adoption, let’s look at what adoption looks like now.

Bitcoin adoption in 2022

With the world shifting into paperless transactions, cryptocurrencies like Bitcoin are more popular than ever. Nowadays, more people are getting their start and trading this new kind of money.

In its earlier years, Bitcoin got a lot of flack from different industries and jurisdictions—some were open to the idea, but others found it challenging to grasp and consider as an asset for long-term use. Now that over a decade has passed and Bitcoin has had time to mature, many are seeing its true potential and powerful applications.

According to a January 2022 market report, the number of cryptocurrency owners is set to reach one billion by the end of the year. Blockware Solutions, an infrastructure provider for blockchain technologies, also did a report and estimated that in 2030, 10% of the global population will use Bitcoin.

Another factor for mass Bitcoin adoption is its acceptance as legal tender, as we’ve seen in El Salvador. Countries are looking at Bitcoin more closely than ever before as a vehicle for sending more efficient remittances and a means for wealth preservation.

But despite more businesses and institutions beginning to accept Bitcoin, its reach hasn’t yet expanded to global adoption. Let’s take a look at a few factors behind this, starting with the Bitcoin adoption curve:

What is the Bitcoin adoption curve?

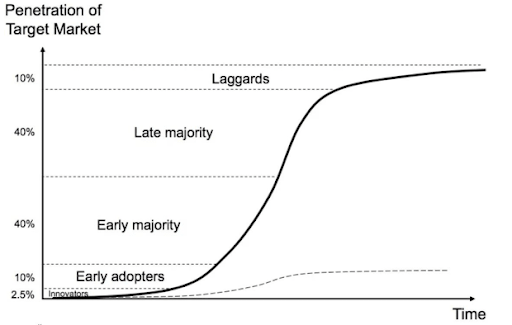

To get a better idea of how much Bitcoin is being adopted globally, people use tools like adoption curves. Every emerging technology and product category has an adoption curve, which is the cumulative rate that a population adopts that product, technology, or service over time.

In every adoption curve, there are five stages: Innovators, Early Adopters, Early Majority, Late Majority, and Laggards. The S curve shown above is what most breakthrough technologies follow.

Many analysts right now believe that we’re still in the latter half of the Early Adopters stage, so there is still ways to go before global adoption.

Bitcoin adoption curve forecast

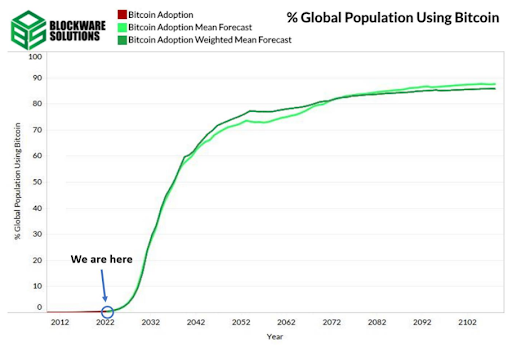

Now that you know what an adoption curve looks like, let’s take a close look at Bitcoin’s curve and see where we’re at in terms of adoption:

In this chart, the red line represents the current Bitcoin adoption rate and the green lines represent where it’s forecasted to go in the coming years.

Here we can see that we’re currently in the middle- to late-Early Adopters stage. If Blockware Solutions’ forecast is to be believed, they predict that global Bitcoin adoption will break past 10% in the year 2030.

Bitcoin adoption curve vs the Internet & other technologies

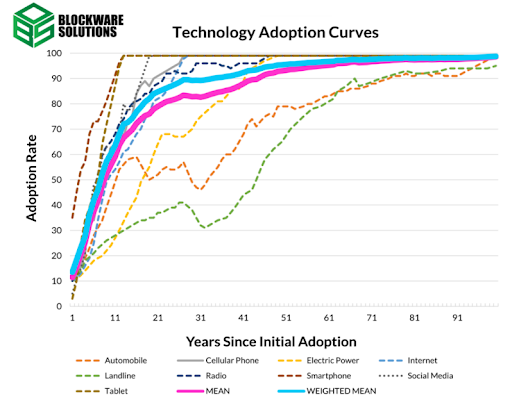

Now, let’s take a look at the adoption curve of some of the other revolutionary technologies over the last century, including the Internet:

The primary point to take away from this chart is that newer, more recent network-based technologies like the Internet, smartphones, and social media reached mass adoption much faster than average.

Considering that Bitcoin is also a network-based technology, it stands to reason that it will also reach mass adoption much quicker than the average.

Key drivers for mass Bitcoin adoption

As we mentioned before, there are a lot of people who own cryptocurrencies like Bitcoin. However, to get to where we want on the adoption curve, there are some driving factors to consider.

Legal and regulatory concerns

Because of its unique features, Bitcoin has the potential to reach the unbanked and underbanked populations, allowing them to participate in transactions they were previously denied. However, this goal is still being blocked in some areas due to legal and regulatory issues that vary depending on the jurisdiction.

Bitcoin is decentralized in nature but countries and their central banks still have the authority over its legalization—to this day, some are still skeptical. On the other end of the spectrum, many Bitcoin-friendly countries have accepted it with open arms like Georgia, Canada, Norway, and Switzerland—so there’s still hope for others to change their mind.

Utilitarian value

Since Bitcoin isn’t globally adopted yet, many people haven’t seen past it being merely a tool for investment—which we all know isn’t the case.

Making payments, transferring money, and preserving wealth are some of the most popular uses of Bitcoin. However, not everyone has caught onto these real-use cases—so the sooner people find out and learn about them, the sooner we’ll achieve global adoption.

Technological capacity

Bitcoin was the first of its kind—a truly digital currency that works and operates through powerful technology. The process of acquiring it—Bitcoin mining—requires high-powered equipment, a stable internet connection, and digital storage space.

Buying Bitcoin, holding, and spending it requires a smartphone or personal computer that has a stable internet connection. Although most people now have access to the digital devices required, having a good connection is another issue. Not all parts of the world have stable internet connections as some countries deal with the costs and unreliable connectivity—and this could be a bottleneck for Bitcoin’s mass adoption.

Bitcoin awareness

With Bitcoin reaching all-time highs in recent years, it’s safe to say that people are aware of it now more than ever. Because of the past two years alone, it has gained a mainstream presence with all the headlines, mentions in media, social media posts, and more.

For Bitcoin to truly make an impact on the world, the next step would be to educate people on how it works. The more they see past the prices, the more they’ll see its true potential.

Next steps

Right now, it seems that global adoption may be far away since we’re still very much in its early stages. However, as Bitcoin matures and people see past its investment purposes, adoption becomes a matter of when, not if.

The main thing we can all do to further this along is to educate people who want to learn more about it and explain to them that Bitcoin is no longer just an investment tool, but a real currency that puts the power back into the hands of the people.