If you’ve been in the crypto space for quite a while now, you’ve probably patiently waited for one of the most important events in the industry—the bitcoin halving. The first and second halving events happened in 2012 and 2016, respectively. This year, on May 11, we witnessed the third bitcoin halving.

This much-anticipated event always leaves questions in every crypto aficionado’s mind: what does this event mean and how does it work? More importantly, what happens to bitcoin and its network after the halving is over? Did it hurt the industry?

Keep reading as we go over everything you need to know about post bitcoin halving, including its effects on the crypto’s price, hash rate, and trading volume, among others.

A quick review of bitcoin halving

Investopedia defines bitcoin halving as being the event “when the reward for mining bitcoin (BTC) transactions is cut in half.” It happens every time the blocks mined reach 210,000, or about every four years.

This event implies that bitcoin’s inflation rate from the previous years and the “rate at which new bitcoin enters circulation” are also split in half.

It was also noted that the two previous halvings brought about cycles of both highs and lows, which yielded higher prices of BTC before the event.

Will the recent bitcoin halving follow the same effects as the previous events? Or will it be different this time? To answer that, here are some of the notable impacts of the bitcoin halving that you need to know.

A significant drop in the network’s hash rate

If you’ve tried cryptocurrency mining, you’ve probably encountered the term hash rate or the measure of the Bitcoin network’s processing power. Simply put, it’s how fast or slow a miner solves the intensely complex problem in the network.

Ideally, higher hash rates are better for miners as they translate to higher chances of mining lots of blocks. More mined blocks will bring miners more block rewards. However, the recent bitcoin halving event’s effects on the hash rate so far don’t look good.

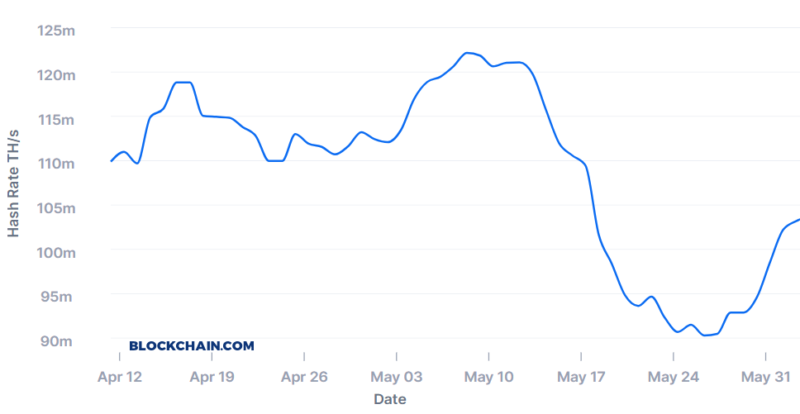

Recent reports reveal that there has been a significant decline in the Bitcoin network since the halving, based on the average block time analysis. Before the halving, bitcoin’s hash rate was roughly 120 EH/s, but after days after the event, it crashed to almost 90 EH/s.

Source: Blockchain.com

The halving has been dramatically affecting miners. During the early years of Bitcoin, miners were able to acquire block rewards of up to 50 BTC. In 2012, miners received 25 BTC per block and 12.5 BTC per block in 2016.

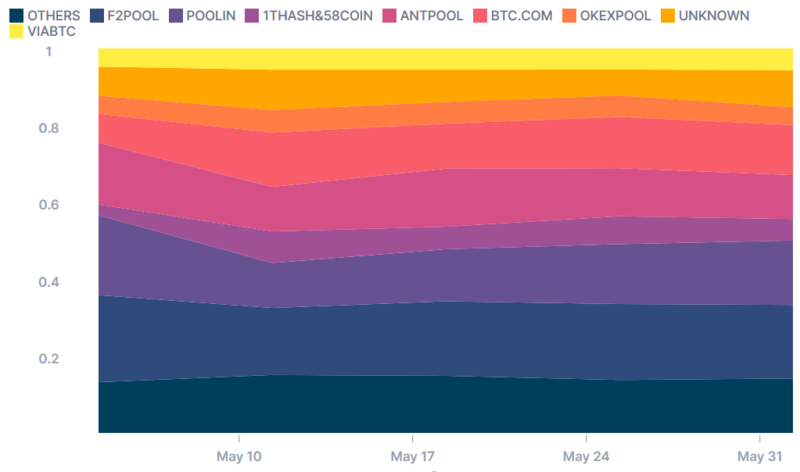

This year, after block 630,000 has been mined, the miners’ reward was cut down to 6.25 BTC per block. Some miners may have been forced to turn off their mining rigs as it’s not profitable post-halving. The chart below shows the hash rate drop among the largest mining pools operating today.

Source: Blockchain.com

Spiking BTC prices

On another note, while miners see a decline in the network’s hash rate, BTC buyers, sellers, traders, and investors are witnessing a steady increase in the crypto’s price. From the past halvings, historical data shows that BTC’s price soars after the event; somehow, the expected bull run hasn’t fully occurred yet.

Another article from Investopedia mentioned that bitcoin’s first halving saw an increase of about 11 USD to almost 1,150 USD. After the second halving event, which happened in July 2016, bitcoin’s price was roughly 650 USD, and by December 2017, it skyrocketed to nearly 20,000 USD. Around a year later, BTC’s rate dipped to around 3,200 USD—a price that was noted as being almost “400 percent higher than its pre-halving price.”

Bitcoin price in USD as of June 9, 2020

Source: Paxful

This year, from prices ranging between more than 7,800 USD to 8,700 USD, bitcoin’s price at the time of writing is climbing up to nearly 10,000 USD. Some cryptocurrency enthusiasts in the industry anticipate BTC’s value continuing to rise in the next couple of months.

A remarkable growth in trade volume

Now that we’ve seen how bitcoin’s halving can affect its price and its network’s hash rate, let’s take a look at the third halving’s effect on bitcoin’s trading volume. Surprisingly, while the hash rate has gone down significantly, BTC’s trading volume is towering as compared to the months before the halving.

Paxful’s data reveals that some of the largest markets, including India, USA, and Nigeria, to name a few, are seeing a significant aftereffect in terms of BTC trading volume.

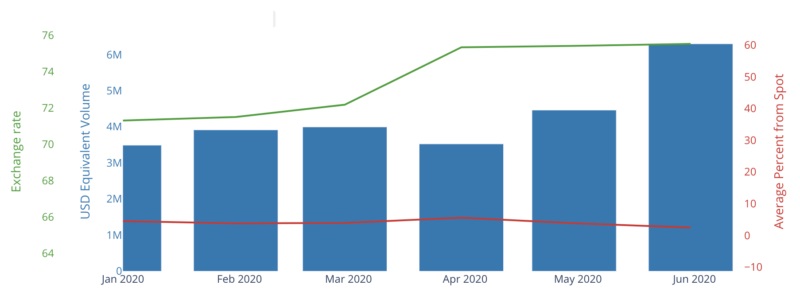

Paxful.com Indian rupee (INR) Volume

USD Equivalent

Source: UsefulTulips.org

From the chart above, we can say that the bitcoin price in India goes on extreme highs and lows unpredictably—just like a roller coaster. This is probably one reason why trade volume is high in the country. Many Indian traders are converting their INR to bitcoin when the price is low and selling it once the rates go up.

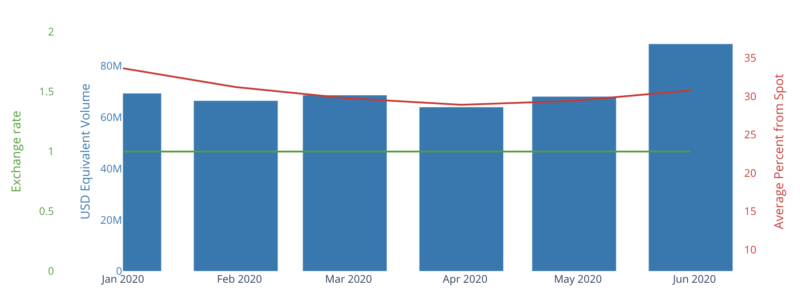

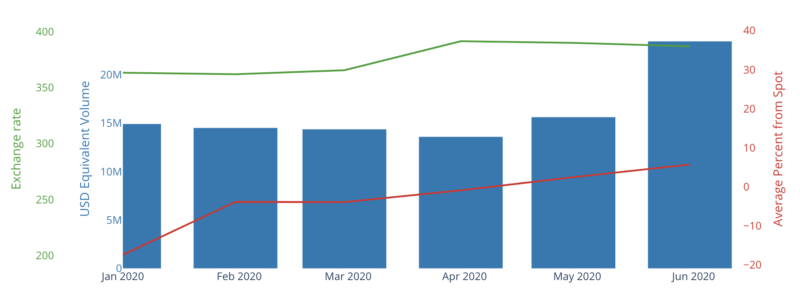

Paxful.com United States dollar (USD) Volume

USD Equivalent

Source: UsefulTulips.org

The same trend can be seen in trading volume for the United States dollar (USD), where the trade volume in June is much higher than the volume from January to May 2020. Another example is the rising BTC trade volume using Nigerian naira (NGN).

Paxful.com Nigerian naira (NGN) Volume

USD Equivalent

Source: UsefulTulips.org

How long will these trends last?

These data results cover just a couple of weeks after the third bitcoin halving. Will it be the same as the previous halvings, which were followed by soaring BTC prices for more than a year? If you’re among the crypto enthusiasts who are wondering how long these trends will last, it’s for you to find out in the next couple of weeks—or even months.

Bitcoin is a highly volatile and powerful digital asset and no one can tell if its price and trading volume will continue to rise from here on. But if you’re very curious about what can happen next, there are some crypto-geek things that you can try out.

Watching BTC’s price and the markets’ movement from time to time, checking out sites where you can view live charts on hash rates and mining difficulty, and always looking out for the latest bitcoin and cryptocurrency news are some things you can do to stay informed.

These tips will surely help you have a better look at the effects of post bitcoin halving. There are some crypto aficionados who say there was never a dull moment in the industry and the bitcoin halving event adds even more thrill to traders and holders. Now that you know all this, take this opportunity to scout and grab great BTC offers while they last!