In the earlier stages of bitcoin’s lifespan, especially during its all-time high in late 2017, many financial analysts accused BTC of being a “bubble.” Just like the bubbles you blow with a wand in your backyard, financial “bubbles” are assets that grow rapidly in value and then disappear in the blink of an eye, effectively “popping” out of existence.

A “bubble” happens when the value of an asset “pops,” or drops quickly after a rapid increase of value. One of the most popular bubbles the world has seen (arguably the standard to which all bubbles are held to) was Dutch Tulip Mania in the 1600s.

What is Tulip Mania?

In the 1600s, people in the Netherlands were experiencing the Dutch Golden Age, mainly due to its growing international commerce and trading operations. That is the birthplace of Tulip Mania.

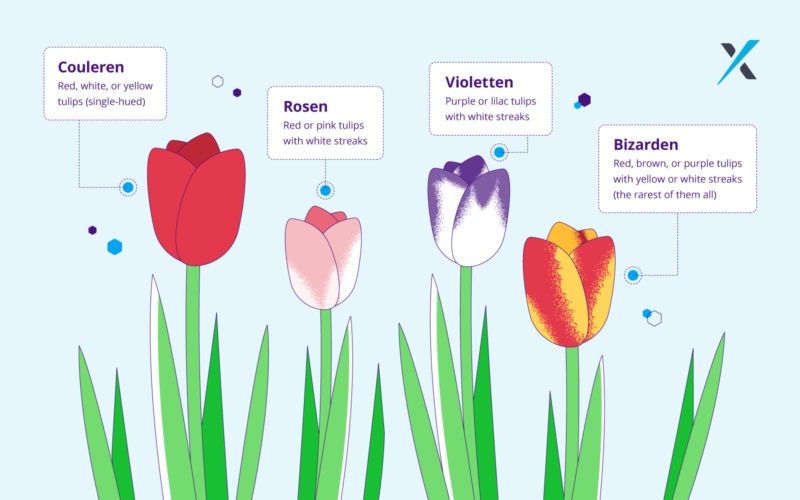

We know what you’re thinking—tulips? The flowers? Yes, you’re right. During this time, the tulips mutated naturally, creating streaks of colors (with different combinations) on the petals of regular tulips. These flowers instantly became a status symbol for those who owned them, creating Holland’s newly wealthy merchant class.

These tulips were highly sought after for good reason. Check out their unique colors:

Because of the novelty of these flowers, demand quickly grew and spot markets were created. Spot markets are where people go to buy financial assets like currencies, securities, commodities, and in this case, tulips. The markets allowed the immediate delivery and trading of these tulips.

However, growing these colorful tulips was painstaking. Usually, it took around seven years for these tulips to grow from seed to bulb and the ones with the mutations could take even longer. From June to September, the dormant phase of the plant, the tulips were allowed to be moved, allowing people to get their hands on the tulips immediately. However, during the other months of the year (October through March), the tulips couldn’t be moved as it would be detrimental to the plants’ lives. Therefore, instead of trading the plants, buyers began using futures contracts to express their intent to buy tulip bulbs at a certain price on a certain date.

The price of these tulips quickly rose as the demand grew. At their peak, the bulbs and contracts were priced even higher than the salary of a skilled worker. Sometimes, they even exceeded the price of a house! Because of this growing demand and rising price, speculators entered the market in hopes of earning a profit.

However, the popularity that these tulips brought enticed more farmers to grow their own tulips. Unfortunately, when supplies rose, demand died down. In February 1637, there was an outbreak of bubonic plague in the Dutch town of Haarlem right before a tulip auction—and that was where Tulip Mania took its dying breath. The contract prices collapsed and no one wanted to trade tulips anymore. As a result, people were holding contracts that were priced at ten times the amount tulips were being sold.

And that’s how the bubble popped, effectively making Tulip Mania the world’s first economic bubble.

Why bitcoin is nothing like tulips

If we’re looking through the lens of past years, it’s understandable to compare the Dutch Tulip Mania with the rising prices of bitcoin. They were both highly valued assets and used as investment tools by many speculators entering the market. However, as bitcoin has developed over the years, the first cryptocurrency has distanced itself from being an economic bubble.

If you look at the technical aspects of the two assets, bitcoin was already very different from the beginning. The flowers had a limited lifespan and with the many mutations available on the market, it became hard to tell the exact variety or appearance just by looking at the bulb. Those who planted tulips hoped that they would get the exact type of tulip that they invested in.

If merchants wanted to trade them, they had to arrange safe transportation as well. Merchants also couldn’t only trade a part of a tulip since splitting a tulip into smaller parts would likely kill the entire plant. Flowers are easily stolen from fields or market stalls, which meant that they were harder to protect. All of these factors made these tulips extremely unsuitable for payments.

Bitcoin, on the other hand, is a purely digital currency. It can be transferred using a global peer-to-peer network. In terms of security, it is protected by robust cryptographic techniques. Want to trade only a part of a BTC? Sure. You can easily buy and sell any fraction of a bitcoin. Money can be sent from anywhere and at any time. You don’t have to hope for anything in bitcoin trading; you get what you invest in.

These factors are exactly why bitcoin is different from tulips. It has a purpose and according to its creator Satoshi Nakamoto, it’s to be a “peer-to-peer electronic cash system” that sheds all the limitations that fiat currencies were burdened with.

At this point in bitcoin’s development, the only similarity BTC and those tulips share is how quickly their prices rose and how sought after both of these assets were.

Bitcoin: beyond the bubble

Other than the differences mentioned above, one key characteristic that puts bitcoin beyond being a bubble is the development of real-use opportunities within trading communities. It is no longer just an investment tool—it’s financial inclusion. People use it to make easier cross-border payments, send cheaper remittances, and protect the value of their money.

In late 2017 or early 2018, it was possible to classify bitcoin as a “mania.” People once called it a “bubble,” but now we can chalk that up as having been fear from past events. The dust has settled. The industry continues to thrive and people still trade regularly. There are still many people hoping to earn big money from investing, but the people using BTC simply to participate financially tell us that it is becoming something more—that it’s maturing as a regular everyday form of currency.