We’re at a point in Bitcoin’s lifespan where people are now using it in their everyday lives and because of its ability to cross borders with ease, sending money abroad has become one of its primary purposes.

So, if you’re looking to send money to the Philippines in the most cost-effective way possible, here’s why it’s much better to do it with Bitcoin.

Better than going through a bank

Banks and their services have been useful tools for a very long time. However, with Bitcoin changing the way we view finance, traditional bank services are beginning to seem a little outdated. Here’s why you should consider using Bitcoin to transfer money to the Philippines instead of a bank:

- Not everyone has access to a bank account

Creating a bank account can be a hassle for people in some areas. Some don’t have any banks nearby and even if there are, a ton of documents, minimum balances, and identification are required to create an account.

On Paxful, all you need is an email address to get your free Bitcoin wallet. With that simple tool, you have all you need to transfer money to the Philippines.

- Sending via wallet address or QR code

To send money to the Philippines using a bank, you’ll need to have international banking codes and documents ready to complete your transaction.

With Bitcoin, all you need is a wallet address or QR code.

- Better exchange rates and lower fees

Remember that banks charge fees for their services, adding a percentage on top of the money you’re sending. If you want to send money to the Philippines using a different currency, which will require conversion, they’ll also give you an exchange rate of around 2-5% below the market rate, meaning if 1 USD = 54.65 PHP, the central bank (BSP) will buy your dollar for P54.38 while local banks will buy it for even less.

With Bitcoin, your fees are much lower, especially if you’re using the Lightning Network. Exchange rates found on the Paxful marketplace are also much better compared to the ones you get from banks.

- Permissionless transactions

Banks will often ask you to justify why you want to transfer money to the Philippines before they process it—which is a much bigger hassle when you’re sending large amounts.

With Bitcoin, you have way more control over your money. Pairing it with the practice of self-custody will give you complete control, eliminating the need for any permissions or justifications.

- Using Bitcoin is faster

Let’s say you decide to jump through all the hoops and send money to the Philippines through a bank. Even then, it could take as long as a week for your money to land in your recipient’s account.

Bitcoin transactions are already quick (taking around an hour at the most), but using the Lightning Network streamlines the process even more, allowing for quicker and cheaper transfers.

Better than traditional money transfer services

Another popular option for sending money to the Philippines is through a traditional money transfer operator. Although they may be easier to access than banks, Bitcoin is still a much better alternative—here’s why:

- Better exchange rates

Like we mentioned earlier, Bitcoin offers the opportunity for the best exchange rates on the market. Traditional money transfer services offer only mid-market exchange rates—good, but not the best.

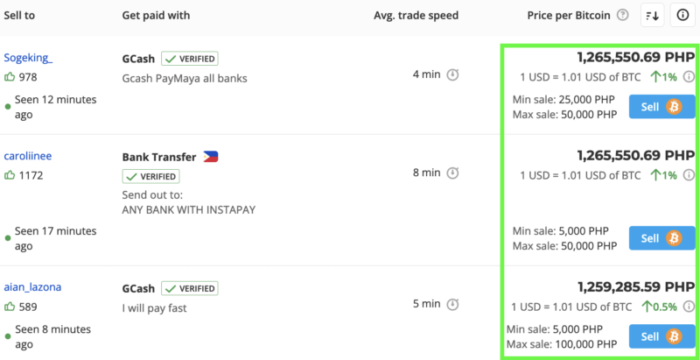

With thousands of trusted traders on Paxful, you have all you need to find the best exchange rates on the marketplace—with some offers allowing your recipient to get more than what you transferred.

- Lower fees

Traditional money transfer operators will often charge fees for their work—which stacks up quite a bit when you send larger amounts.

When you buy Bitcoin on Paxful, there are no fees at all while cashing out BTC will, in most cases, only cost you a 1% fee. You also get 1,000 USD worth of feeless transfers between Paxful wallets per month.

For more information on Paxful’s fees, check out this article from our Help Center.

- Cash out in over 450 ways

The best part about using Paxful to send money is that your recipient has over 450 ways to cash out—giving them ultimate flexibility over the transfer.

GCash, PayMaya, PayPal, and bank transfers are some of the most popular ways Filipinos cash out on Paxful.

- Convenience

Don’t have time to head to the nearest remittance center? With Bitcoin, you and your recipient can send and receive money from the comfort of your own homes. All you need to do is head to Paxful on your web browser or open up your Paxful app to send/receive remittances in a matter of minutes.

How to send money to the Philippines using Bitcoin and Paxful

Now that you know all the benefits of transferring money to the Philippines with Bitcoin, here’s how you can do it on Paxful:

- Create your Paxful account

You and your recipient will both need to create a Paxful account to get started—don’t worry, it only takes a few minutes and you even get a free Bitcoin wallet. - Buy Bitcoin from a verified Paxful user

Head to the Buy Bitcoin page, select which payment method you want to use, and start a trade with one of our many verified sellers.

Pro tip: before you start a trade, remember to take a look at all the details of the offer: the price, offer limits, reputation score, and seller availability.

For the ultimate guide on how to buy Bitcoin, check out our beginner’s guide on how to use Paxful. - Send the Bitcoin to your recipient’s wallet address

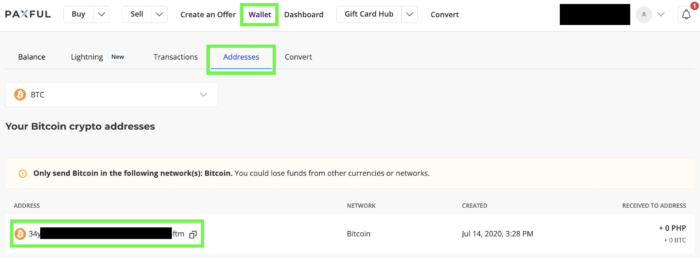

Once you have the Bitcoin in your wallet, you can send it to your recipient’s wallet. The recipient’s Bitcoin address can be found if they click Wallet and then the Addresses tab:

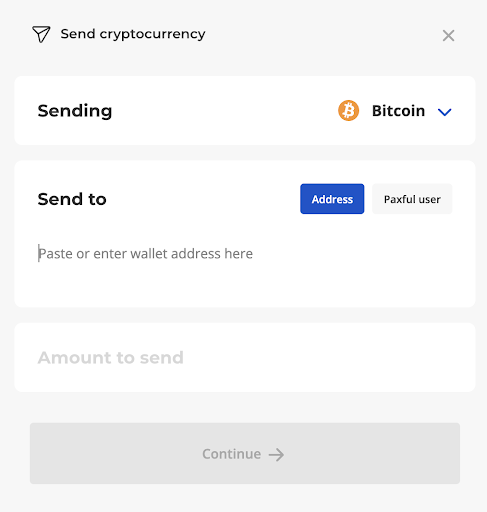

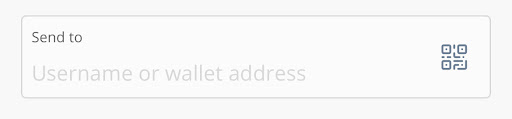

Ask your recipient to send you their wallet address then head to your wallet. From there, look for Bitcoin (BTC) under Assets and then click Send. Next, paste your recipient’s wallet address and input how much you want to transfer.

Alternatively, if you’re using the mobile app, you can scan your recipient’s QR code by clicking on the QR button.

- Your recipient can now convert their Bitcoin

From here, your recipient has the option of keeping the money as Bitcoin or cashing out in over 450 ways.

If they want to convert it, all they need to do is head to the Sell Bitcoin page and look for an offer that matches their preferred payment method. Just like the Buy page, there are also many verified buyers on the marketplace.

International payments made cheaper with Bitcoin

Bitcoin is changing the game for remittances, especially if you want to send money to the Philippines. Taking these few extra steps to transfer money with Bitcoin can not only make your transactions faster, but cheaper as well.

Try it out now and experience the future of remittance!