In the simplest of terms, Quantitative Easing (QE) means increasing the money supply in order to spark the economy. A country’s central bank begins by purchasing long-term securities from the open market (such as mortgage-backed securities or MBS). This increases the supply of money in the economy, lowers interest rates, and expands the banks’ balance sheets while promoting lending and investments.

Try to imagine the market as a bathtub, with the central bank as the tap and the banking system as the drain. Ideally, they should both operate in equilibrium, keeping the bathtub’s water level constant.

The problem is when the banking system drains the water too fast, shrinking the total available supply all around. In these situations, QE programs could help by preventing the bathtub from emptying out totally, much like what happened during the Great Depression.

How exactly does quantitative easing work?

As the supply of money grows once QE is initiated, banks around the country will be able to offer loans at much more affordable rates. This will make it easier for people to borrow money—which will eventually be spent and recirculated, invigorating the economy.

Another effect this will have is that investors will face lower returns on their fixed-income assets. This will signal a change, with investors diverting their attention towards more profitable investments in the current economy, like stocks.

Potential issues with quantitative easing

Sometimes the benefits of quantitative easing aren’t as universal as they should be, meaning that other players within the economy can suffer as a result. When a central bank begins quantitative easing, the target benefactor is the stock market.

This has caused a debate about whether QEs actually help. The argument is that even if the market activity was rekindled, those who need financial assistance would be less likely to catch up. Stock owners, meanwhile, are generally made up of individuals who are already financially well-to-do.

Quantitative easing could also worsen inflation. Printing more money will cause businesses to charge more for the same products as the buying power of the currency decreases. Left unchecked, this could cause instability within the economy or even stagflation.

Examples of quantitative easing

Now that we have a better idea of what QEs are for and how they happen, let’s take a look at a few specific examples to really understand.

QE1, a program launched in the United States in 2008 lasting until 2010, was when the US Federal Reserve purchased 600 billion USD worth of mortgage-backed securities and another 100 billion USD in other forms of debt. This happened in the midst of the housing crisis that crippled the economy and allowed the domestic market to recover. The movie, “The Big Short” accurately portrays the housing market collapse and how quantitative easing was applied to bail out banks and other “too big to fail” institutions.

A more recent example of a QE is the one that was executed by the US Federal Reserve during the early stages of the pandemic. As the economy took a blow during the lockdown, the Fed would come to the decision that a QE was in order, buying 700 billion in bonds. This would act as a preventive measure against the forecasted lows caused by the coronavirus pandemic.

What are its effects on the stock market?

As we’ve mentioned earlier, one of the main goals of QE is to influence investors to choose investment options that are long-term and have a high return on investment. This can help stabilize the economy, and with bank loans available at lower interest rates, private individuals (also called retail investors) should be able to participate more freely within the market.

As the stock market grows, foreign investors will see signs of a growing economy and increased investor confidence. This can encourage inbound investments, pushing the domestic market to thrive. This is because quantitative easing is like a government sending a message to investors that they want to stimulate economic growth.

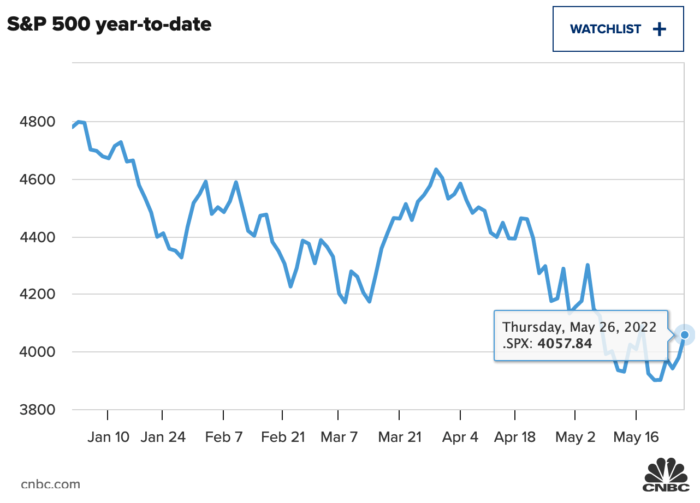

But what happens when QE is halted? In the US, turbulence was felt by the stock market as soon as the US Federal Reserve signaled the end of money printing in early 2022. US stocks struggled to recover from weeks of losses amid the end of QE and worsening inflation.

How did QE affect Bitcoin?

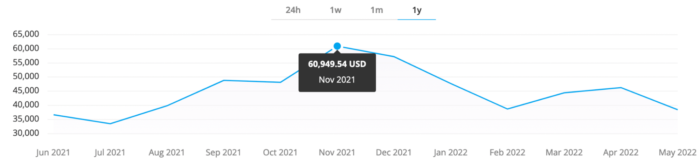

All this brings us to the question, “How does quantitative easing affect Bitcoin?”. That’s reasonable since Bitcoin is decentralized, right? Most people fail to consider that quantitative easing has already helped Bitcoin in the past. As the market grew and stocks reached all-time highs from QE, Bitcoin benefited as one of the alternative investment assets whose price also rose to all-time highs.

That’s because quantitative easing, in theory, pushes investors to choose profitable assets, which can be said of Bitcoin despite its volatility. This has given investors more reason to invest in Bitcoin, further improving its reputation as emergency insurance for many people in the market.

Learning lessons from centralized finance

While Bitcoin is not supported by any mechanism that generates cash flow, it is seen by institutional investors as a trading asset class. The abundance of money created by quantitative easing tends to push the price of speculative assets, like stocks and Bitcoin, to reach incredibly high levels.

But the point of all this is that there are always lessons and tools we can borrow from centralized financial institutions, even if Bitcoin is a decentralized currency. There’s bound to be a tool or strategy we can use as Bitcoin users.

What we have to remember is that we shouldn’t solely rely on them. There are pros and cons to most things, including quantitative easing. The best thing we can do for ourselves is to keep updated on what’s happening, both in centralized and decentralized markets. With more information, being confident with your investment decisions should come easily.