Just like a car needs its fuel and humans need food for energy, the Ethereum (ETH) network needs gas to facilitate its transactions. Ethereum gas is an essential part of the network and most of the time, it can get expensive (to say the least).

What is Ethereum gas?

Ethereum gas is essentially the costs or fees for making transactions on the Ethereum blockchain. Gas is used by the Ethereum Virtual Machine (EVM) so that decentralized applications can run and self-execute smart contracts in a secure and decentralized fashion. They’re your way of compensating stakers who validate your transactions.

Each unit of gas has a price denoted in gigawei (gwei) or nanoeth. A gwei equals 1,000,000,000 wei, which is the smallest Ether unit base. To give you a better idea of the conversion to Ethereum, one wei is equal to 0.000000001 ETH.

Why are ETH gas fees so high?

One of the things that make ETH gas computation so tricky is that it’s never been a fixed price. The amount of gas you’ll need to pay will depend on how large or complex your transaction is. For example, a complicated transaction could easily set you back 1,000,000 gas while a simple transfer would cost only about 21,000.

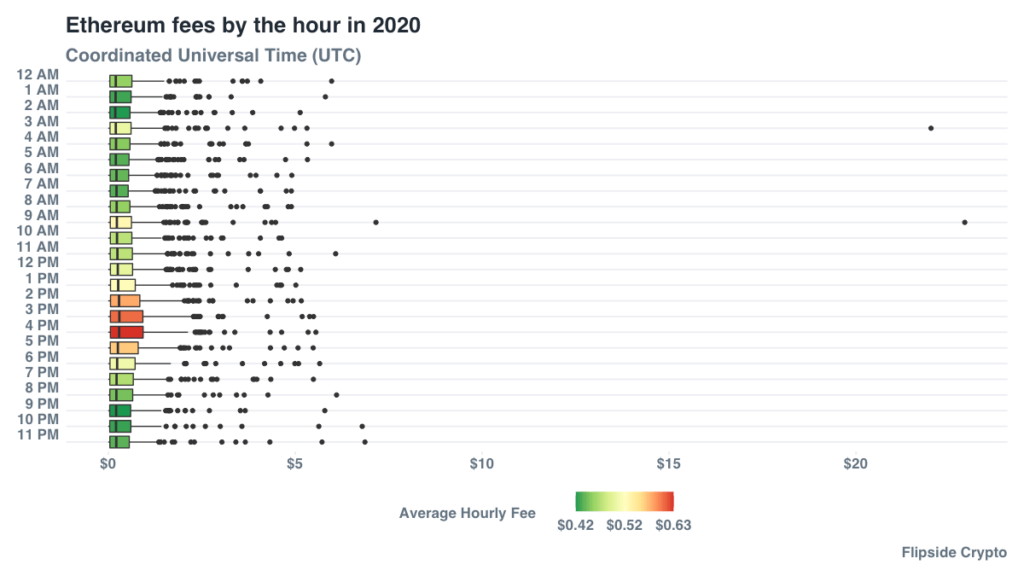

Another thing that factors into high ETH gas fees is the time of day of the transaction. The more people transacting, the more congested the network becomes, resulting in higher gas fees.

Why ETH gas fees fluctuate

In most cases, Ethereum gas and fees are mainly determined by the supply and demand between the network’s validators. This means that they can decline a transaction if the gas price doesn’t meet their standards. It also means that the cost of gas fluctuates with the supply and demand for processing power.

This is where the “Ethereum gas limit” comes in. “Gas limit” refers to how much you’re willing to spend on a transaction. Setting a higher gas limit lets you tell the Ethereum validators that there’s more work to do for a transaction. At the same time, validators can ignore your transaction if you set the gas limit too low. This is why are gas fees so high on a particular day and time.

Another possible reason ETH gas prices fluctuate is because of whales—wallets that hold over 20 ETH (around 65,000 USD at the time of writing).

Source: flipsidecrypto.com

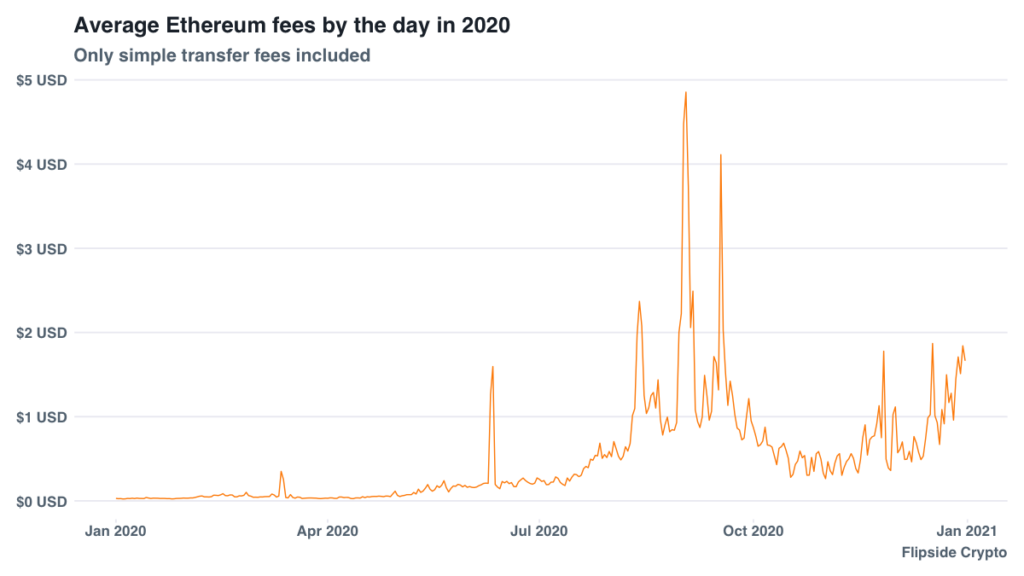

Source: flipsidecrypto.com

By looking at charts at the points when both spikes coincide, it can be correlated that the fees increase when these whales make transactions. The time when the network is least busy is the time when Ethereum gas fees are lowest. Although we can’t be certain that they’re the main reason why prices surge, it can be deduced that they play a significant role.

When are ETH gas fees lowest?

Looking to save money on your Ethereum transactions? Well, you’re in luck. We studied Ethereum gas charts and found the best times to transact.

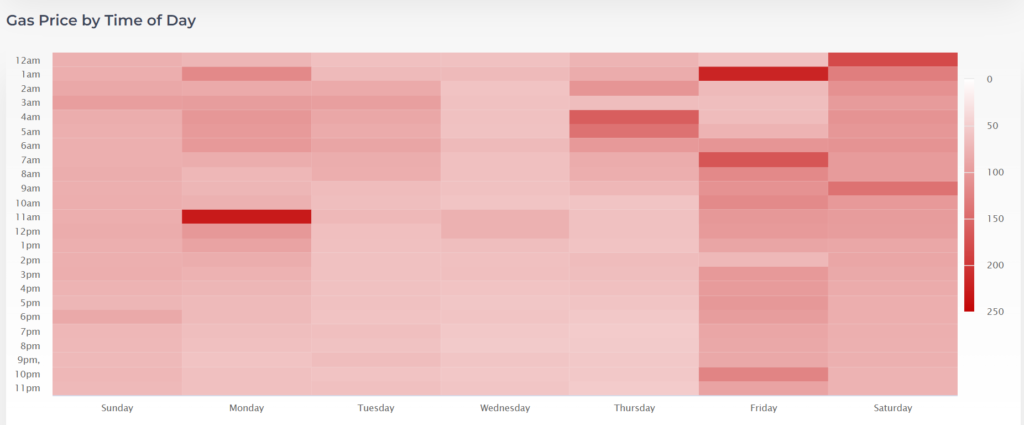

Source: ethereumprice.org/gas/

The busiest times and the most expensive times are on weekdays from 8 AM to 1 PM (EST). This comes as no surprise because Europe and the US are all fully awake and at work during that period. On weekdays, ETH gas price is lowest from midnight to 4 AM (EST)—when most of America is asleep, Europe is just about to start their day, and Asia is finishing up their workday.

The best time to make an ETH transaction is on a Saturday or Sunday from 2AM to 3AM (EST)—that’s when ETH gas prices are at their lowest. On the other hand, the worst times are on Tuesdays and Thursdays, when the network is at its busiest and gas prices are at their highest.

| Day | The time when ETH Gas is lowest (EDT/EST) |

|---|---|

| Sunday | 2 AM to 3 AM |

| Monday | 1 AM to 2 AM |

| Tuesday | 6 AM to 8 AM |

| Wednesday | 11 PM to 7 AM |

| Thursday | 1 AM to 3 AM |

| Friday | 10 PM to 8 AM |

| Saturday | 2 AM to 3 AM |

All this data means that if you hold off a bit on your transactions or send lower fees for low-priority transactions knowing that they’ll be confirmed in a few hours, you could save some gas in the process.

With the price spikes of Ethereum (and with it, its rising fees), it might be worth looking into how you could save some gas. Find the best times to buy Ethereum and then plan them accordingly. Who knows? It could save you a lot of money.

How to reduce Ethereum gas fees

Now that you know why gas fees are so high, you can work around them to make the most out of your transactions. Mainly, there are three cost-saving solutions for Ethereum’s rising gas fees:

- Plan ahead

One of the first things you should start doing to reduce your Ethereum gas fees is to plan your transactions accordingly so that they coincide with a decongested network. As mentioned earlier, the best time to transact on the Ethereum network is during midnight over the weekend. - Try a layer 2 solution

Just like how Bitcoin has the Lightning Network, Ethereum also offers layer-2 solutions—networks built on top of a blockchain to help boost capability, offload work, reduce congestion, and avoid single points of failure—that allow you to get the lowest ETH gas fees. In the world of Ethereum, these are called Rollups. If you want to explore these types of solutions, you can check out Arbitrum, Optimism, Polygon, or Loopring. - Use tools to calculate your gas fees

Another tricky thing about gas fees is that you won’t know the actual gas fee until you carry out your transaction. In most cases, people will just wing it and worry about the gas fees later. To see how much you’re going to pay before making your transaction, there are applications that’ll give you an idea of what gas fees are going to look like. Apps like DeFi Saver will let you simulate your transaction and show you the gas fees in real-time. By simulating it before making the actual transaction, you’ll have a better idea of your costs.

Ethereum’s unique gas problem

As unique as it is to Ethereum, gas fees raise a couple of concerns for ETH users. Despite how high fees can get, it’s a standard feature on the Ethereum network. Granted, there are extra steps one can take to avoid these high fees, but it’ll require a lot of education and patience. The high gas fees affect many great things on the ETH network—ERC-20 token purchases, micropayments, NFT markets, and more.

To put this into a real-world example, let’s say that you’re looking to get yourself an NFT that’ll set you back around 100 USD. Would you be able to justify that purchase if the gas fees are just as expensive as the actual NFT? In this case, you’d probably think twice and possibly try to save on fees.

With future Ethereum upgrades on the horizon, users remain hopeful that gas fees will eventually be reduced. As for when that upgrade comes, we’ll just have to wait and see. Right now, we have to play with the hand that we’re dealt with. Gas prices are high, so it might benefit most to stick to something tried and tested like Bitcoin and its already-proven Lightning Network—at least until we see what happens when (or if) the Ethereum developers solve the gas problem.

*Disclaimer: The content of this article is for informational purposes only. The opinions expressed here are not meant to be taken as financial, investment, or any other advice, nor do they express the opinion of Paxful.

*This blog was originally published on March 26, 2021 and updated on January 21, 2022.