In Latin America, banking isn’t as easy as you think. Even if you’re lucky enough to get access to a bank, the fees can get overwhelming. At the same time, your access to other currencies may be limited.

So what are people doing to solve these problems? They’re turning to cryptocurrency. These are the problems driving cryptocurrency usage up—and they don’t only affect businesses, but individuals as well.

The beauty of crypto remittances

Long wait times and high costs are often synonyms of traditional means of remittance. Luckily, cryptocurrencies don’t have that problem!

Crypto remittances are not only faster, but they’re cheaper as well. There aren’t any middlemen and hidden charges to eat away at the money you’re sending. All you need to do is find out where to buy Bitcoin and store it, and you’re all set.

Since crypto is decentralized, which means it isn’t tied to any specific government or institution, you can send as much money as you want at any time to anywhere in the world. Don’t forget: banks and money transfer operators (MTOs) are sometimes closed on weekends and holidays, automatically hindering your ability to send money. What if it’s an emergency and a family member needs money? Crypto might be your answer.

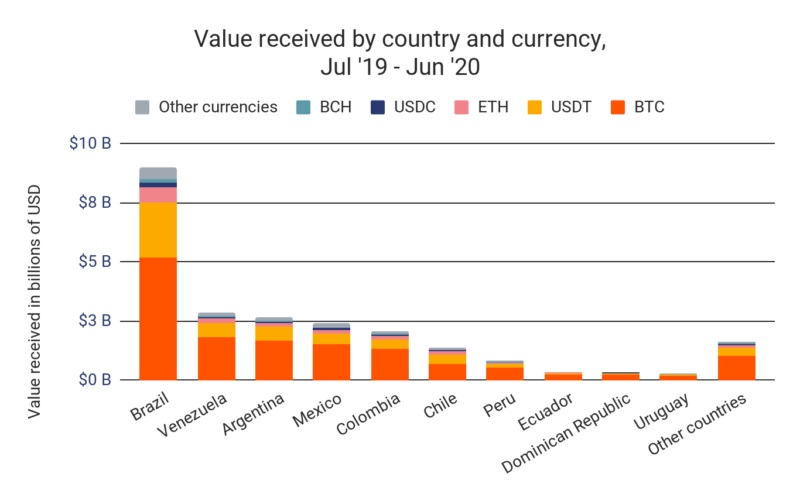

Chainalysis, a global blockchain analysis company, released a report stating that 25 billion USD worth of crypto has been sent from Latin America and 24 billion USD worth of crypto received. The report mentioned that “the region represented between 5% and 9% of all cryptocurrency activity in any given month over the last year.”

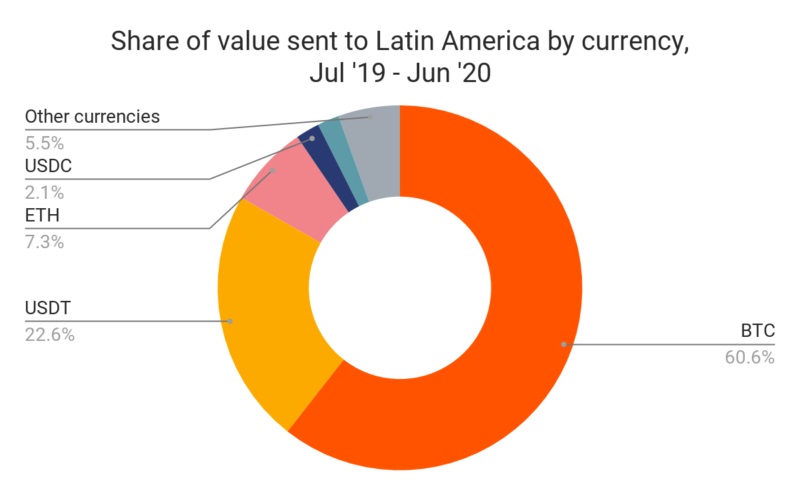

Source: Chainalysis 2020 Geography of Cryptocurrency Report

Currencies included: BAT, BCH, BNB, BTC, CRO, CRPT, DAI, ETH, GNO, GUSD, HT, LEO, LINK, LTC, MCO, MKR, MLN, OMG, PAX, TUSD, USDC, USDT, WETH, ZIL, ZRX

Source: Chainalysis 2020 Geography of Cryptocurrency Report

Currencies included: BAT, BCH, BNB, BTC, BUSD, CRO, CRPT, DAI, ETH, GNO, GUSD, HT, HUSD, ICN, LEO, LINK, LTC, MCO, MKR, MLN, OMG, PAX, PAXG, TGBP, TUSD, USDC, USDT, WETH, ZIL, ZRX

The report’s data shows that Bitcoin dominates this space, with Tether (USDT) being a not-so-close second. This is surprising because USDT is usually a close second as stablecoins allow people to retain the value of their money and reap the rewards of using cryptocurrency. Afraid of volatility? No worries, you can just buy Tether and keep that 1:1 ratio with the US Dollar.

USDT, compared to USD, is much faster because it’s more accessible. Depending on the country you live in, you’ll probably have to go through a lot of hoops just to exchange your money. In some cases, you may even be limited in the amount that you exchange. With USDT, it’ll only take you a few minutes to exchange as much as you want. Additionally, Tether may be more widely accepted since the use of USD is limited to countries where it’s considered legal tender, like the United States.

Crypto as a store of value

We mentioned earlier that countries all over Latin America are experiencing hyperinflation. This means that their native currencies are experiencing a lot of instability. Imagine the value of your money going down more and more each day. That can’t feel good, right? That’s why trade volume for Bitcoin in Latin America is skyrocketing. People need a currency that’s a better store of value.

Obviously, with some cryptos being better stores of value than others, there are choices to make here, so let’s use BTC as an example.

Three things make BTC a great store of value:

- Portability – Your wallet will never be chunky since BTC is stored in a digital wallet, most likely on your smartphone!

- Fungibility – It doesn’t matter which coin you have; all have the same value.

- Divisibility – Just because Bitcoin’s prices have reached an all-time high recently doesn’t mean they’re expensive to get. You can buy fractions of a Bitcoin and reap the rewards of crypto without having to spend 19 grand (1 BTC = 19,301 USD; at the time of writing).

With cryptos like Bitcoin turning out to be a great store of value, people experiencing instability with their native currencies are flocking towards digital coins as a means of wealth preservation.

Peer-to-peer platforms as a saving grace

Because access to banks is limited in Latin America, many people are automatically disqualified from participating in online transactions. Peer-to-peer (P2P) crypto marketplaces can be a solution to that problem.

They act as a financial passport that allows the underbanked and unbanked to make online transactions, especially in Latin America.

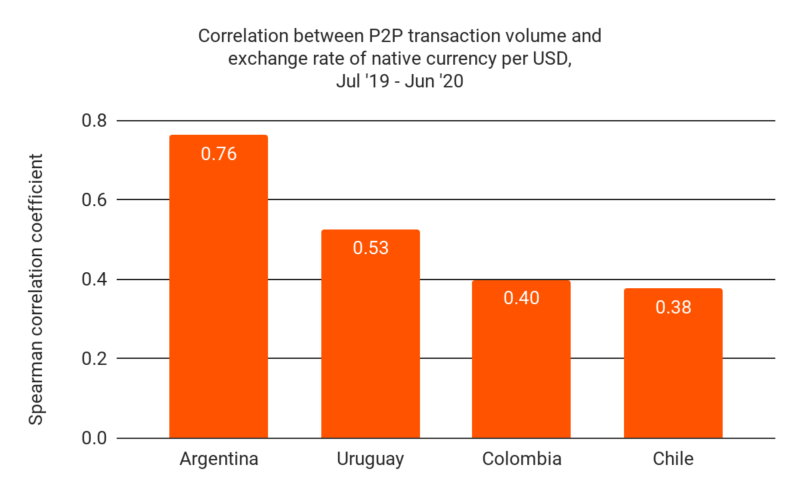

Source: LocalBitcoins, Paxful via CoinDance

Currencies included: BTC

The bar graph above shows that people from these countries turn to crypto as a store of value, especially when their native currencies experience hyperinflation.

With the peer-to-peer aspect integrated into the trading system, the volatility of cryptocurrencies is rendered irrelevant. It doesn’t matter how expensive Bitcoin may be if you’re trading a gift card for it, right? People are getting real goods and finding real money-making opportunities through this type of trading and that speaks to just how revolutionary P2P finance is.

Using Latin America as an example

There’s a lot to learn from how people use cryptocurrency in Latin America. It shows us that cryptocurrencies are not just investment tools—they’re much more than that. They can be your way of buying that new gadget you’ve wanted but never had the bank access to buy, sending money to a loved one in a cheap and fast way, or even just a means of survival.

As we move forward through the cryptocurrency age, we believe that we’ll start seeing more real-use cases pop up. People will find more ways to use crypto in their daily lives. And as we inch our way closer to mainstream adoption, we’ll start seeing these new opportunities as normalities—and we can’t wait for that.