Bitcoin has been standing its ground and has even gained popularity despite the crypto winter. This has led many community members to start asking questions about the network and how it works. One question that people want to get to the bottom of is: “How much of the current Bitcoin supply is liquid?”

Defining liquidity and illiquidity

Let’s start with the basics—what makes an asset liquid or illiquid? Liquidity is used to describe how ready an entity is to spend. A highly liquid asset, then, would be one that is free to be used to cover expenses.

Illiquid assets, on the other hand, would be those that won’t be as easy to sell at their appropriate value. This could be attributed to a few factors, one of which is the expense involved in selling the asset. This doesn’t mean that they don’t hold value well—it could be quite the opposite, in fact. This only means that it might take longer for you to find the right opportunity where you can sell off the asset at the right price.

Examples of liquid and illiquid assets

To help give you a better idea, let’s take a look at a few examples.

The easiest example for liquid assets would be cash—after all, there’s a reason why people say, “cash is king.” You can use cash the moment you need it, and its value will be precisely what you expect it to be. Another example would be stocks, which aren’t as liquid as cash but can be sold quickly enough in a relatively short amount of time in a ready market.

Other examples of liquid assets include:

- Well-established markets

- Bonds

- Stocks

- Money markets

For illiquid assets, real estate would be a good example. Real estate properties often hold a lot of value but selling them quickly often means not realizing that value. To get the right price for real estate, you will most likely need a real estate agent to help you present the property in its best light. That means spending on open houses as well as the agent’s fee.

Other examples of illiquid assets include:

- Hedge funds

- Penny stocks

- Cars

- Antiques

- Artwork

Is Bitcoin a liquid or illiquid asset?

Now, to the meat of the issue—can we consider Bitcoin a liquid or illiquid asset? If you focus on the fact that we can easily convert it into cash, we can describe Bitcoin as a liquid asset. However, this comes with some considerations as certain factors come into play:

Trading Volume

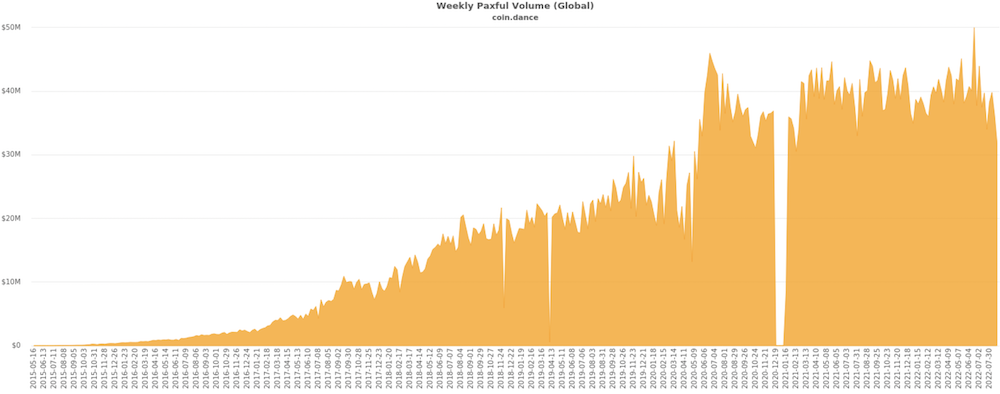

Bitcoin’s trading volume plays the biggest role here as it determines the supply of Bitcoin circulating in the market. In simple terms, it describes the market activity of the coin by measuring the coin’s movement over the last 24 hours.

The higher the trading volume, the more we can expect to find people actively trading Bitcoin on the market. This means it’s easier for people to buy BTC when they need it or to convert their BTC into fiat currencies.

Exchanges

The number of available exchanges will also be important. In simple terms, with more available exchanges, the more opportunities there are for people to trade their Bitcoin for cash.

The condition here is that the available exchanges have to perform at a certain level for people to be comfortable. Security will be the biggest factor, with convenience a close second. As long as these conditions are met, we can be confident that market participants will find it much easier to participate in trades.

Acceptance

The rate of adoption and acceptance of Bitcoin is another important factor. A higher acceptance rate means that Bitcoin is being used as an actual medium of exchange which in turn boosts its utility and decreases its volatility.

Bitcoin as a medium of exchange has been steadily developing over the years, with more and more payment solutions and e-commerce websites accepting Bitcoin as payment for goods and services.

The introduction of the Lightning Network has pushed Bitcoin’s utility by allowing coin holders to use BTC for microtransactions. We’re making steady progress, but Bitcoin still has some ways to go before reaching its full potential.

Regulations

As we’ve seen in the past few years, the introduction of regulations and restrictions in the cryptocurrency industry have manifested themselves in fluctuations in Bitcoin’s value. We can hardly blame the market for reacting this way.

In the past, we’ve seen some countries show full support for Bitcoin by accepting it as legal tender—others, meanwhile, have chosen to limit or downright ban its use, resulting in less confidence in the market. However, public outlook and insight will play a big part in this scenario since we are the ones who are trying to participate in the market.

Awareness

Finally, we have awareness of Bitcoin and how it works. Despite its popularity, many people are still unaware of exactly how Bitcoin works and how it might help them. The current number of Bitcoin users, then, is restricted by information. The most obvious solution to this problem is through education.

Take any of Paxful’s educational centers as an example. Through these centers, Paxful aims to enlighten individuals on how Bitcoin works and how they can benefit from the blockchain. Now, we aren’t saying we have to focus on just education centers—what’s most important is that we can share the necessary information with others.

How much of Bitcoin’s supply is liquid?

Currently, Bitcoin liquidity is seen to be at 22%, with only 4.2 Million BTC in constant circulation. That’s not a lot, considering how we currently have 18,925,000 BTC in supply. That makes 78% of the circulating Bitcoin supply illiquid, meaning that 14.5 million BTC are currently inaccessible to the market.

Of the 14.5M illiquid Bitcoin, 20% of it is “lost,” according to Chainalysis. These Bitcoins are gone forever as they are either stored in a locked online account, or the hardware wallet from which they are stored is damaged or lost.

What does low Bitcoin liquidity tell us? For the most part, we can say that market participants are lessening their spending of BTC, instead accumulating their Bitcoin for long-term investments. This is neither inherently good nor bad but is a definite shift in market behavior.

Does Bitcoin have an illiquidity issue?

Financial institutions, hedge funds, and large companies have been hoarding Bitcoin for treasury reserves in the past few months. And as supply became scarce, the market pressure to sell was reduced, and the price of Bitcoin soared.

Low Bitcoin liquidity due to scarcity can be beneficial and shouldn’t directly affect low-volume traders since there’s enough supply to go around. It can be a problem for entities that want to trade Bitcoin in bulk as there are limited exchanges than can support such activities.

It should be noted that Bitcoin illiquidity of another kind might be triggered if large financial institutions decide to cash out their Bitcoin, especially if done in a single transaction. The sudden influx in Bitcoin supply can result in a lower price and cause other market participants to panic sell. If more people are selling rather than buying, then Bitcoin illiquidity due to lack of demand may become a problem.

The importance of knowing Bitcoin liquidity

So why is this information important? The more we know about Bitcoin’s liquidity, the better we can understand how the market is currently behaving—whether people are using their Bitcoin for their daily purchases or if they’re accumulating their BTC. The better we understand the current mood of the market, the better we can make informed decisions when it comes to trading out Bitcoin.

All this goes to remind us that Bitcoin is still a young currency. We’ve yet to achieve the liquidity that we can see with traditional currencies, one of the reasons why we observe such sudden movements in Bitcoin’s value.

With improved liquidity, we should see less risk in the market since the currency would be utilized more efficiently. Improved regulatory support, better awareness, and increased acceptance will play the biggest role in improving the liquid share of Bitcoin’s supply—all of these things that we, as market participants, can help with.