The current Bitcoin all-time high price at the time of writing (December 2021) is 68,789.63 USD. As impressive as that is, it took over a decade of highs and lows before BTC reached this staggering value. Bitcoin (BTC) is succeeding in showing the world its potential and advantages, rapidly cementing its place in the world of finance.

It wasn’t always like this, however, as we reached new BTC all-time highs that were once thought of as impossible. Let’s take a look at the initial price of Bitcoin, how it has changed over the years, and where its price sits right now. It would be interesting to see how Bitcoin’s development over the years has affected how we value crypto today.

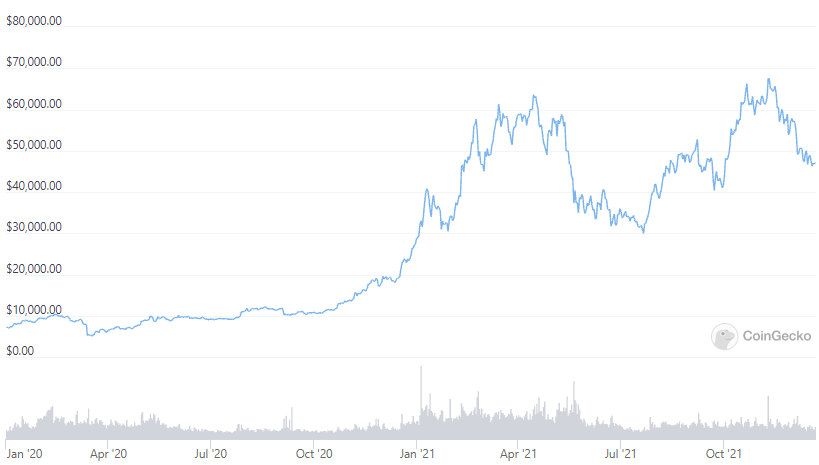

BTC Price Chart

Source: CoinGecko

Inception and early growth

(2008-2013)

In the beginning, the idea of cryptocurrencies was totally alien to people. It was first introduced when an anonymous internet user by the name of Satoshi Nakamoto registered the domain name Bitcoin.org and published the Bitcoin whitepaper on Oct. 31, 2008 (the agreed anniversary date of Bitcoin’s founding).

In 2009, the Genesis Block—the first block on the Bitcoin blockchain—was created. At this point, the nature of the coding of the first 50 BTC did not allow for the currency to be spent. However, that same year, the New Liberty Standard priced Bitcoin exchange to be at 1 USD to 2300.03 BTC.

Fast forward two years later and Bitcoin has successfully reached a 1:1 ratio with USD. In the next four months, the value would turn into 31.91 USD per BTC. Unfortunately, this would not last long as just a few days later, prices would drop to 10.25 USD. It was at this point that Bitcoin started developing a reputation as something too volatile.

In 2012, we saw the first Bitcoin halving occur after the first 210,000 blocks were mined. From earning 50 BTC rewards, Bitcoin miners now only make 25 BTC. For coin holders, Bitcoin would prove a good investment, climbing up to 200 USD in April of 2013.

Sometime that year, the world would see the Dark Web site, the Silk Road, taken down by authorities. Over 26,000 BTC would be seized in this operation, dropping Bitcoin’s price from 139 USD to 109 USD.

November 2013 would prove to be a rollercoaster for coin holders; Bitcoin would reach prices equivalent to gold’s, at least 1000 USD. This wouldn’t last long, however, with prices dropping to a range of 600 USD and hovering in that range for the next few months.

Identity and development

(2014-2016)

In the sixth year of Bitcoin’s existence, the biggest leap forward would come in the form of Microsoft’s acceptance of Bitcoin payments. They would be the first in a long line of big-name corporations to adopt the currency as a payment method.

While no notable BTC all-time high would be recorded in this period, the next two years would see Bitcoin stabilizing. This would combat its previous reputation and show users the capability of the currency.

2016 would also see the second halving of Bitcoin mining rewards. From 25 BTC, miners would now only get 12.5 BTC.

BTC Price History from January 1, 2014, to December 30, 2016

Source: CoinGecko

Early preview

(2017-2019)

Bitcoin holders would find a reason to celebrate at the start of 2017, with January 2 seeing a Bitcoin price breaching the 1000 USD mark once again. People would find this suspicious as the price would dip for a few months before reaching new highs.

By June 2017, Bitcoin would reach 3000 USD, a first for the crypto market. This occurred at a time when scaling issues were prominent, possibly implying the intent people had with adopting the currency into more daily use.

This implication would show itself to be true, despite in-fighting among some of the crypto’s followers. In September, Bitcoin would go on to reach 5000 USD per BTC. Volatility would affect the coin for a while, with Bitcoin reaching 3000 USD before rebounding.

This volatility was caused by China banning the use of cryptocurrency in transactions and exchanges. It was around this time that JPMorgan Chase CEO Jamie Dimon claimed bitcoin to be a fraudulent currency—which didn’t help its price either.

In the end, it wouldn’t matter. November of 2017 would see Bitcoin pass the 10,000 USD mark and, surpassing that, reach 11,000 USD. The all-time high for the year would be seen in December though. Bitcoin that month would see a record 20,000 USD price point. Sadly, this wouldn’t last too long, with the currency dropping to 13,000 USD.

This amazing run through the year of 2017 couldn’t last forever though. At the start of 2018, the price of Bitcoin would drop to 10,000 USD as a result of fear, uncertainty, and doubt concerns invading the market.

Facebook this year would also start banning advertising for cryptocurrencies and ICOs on its platform. What wouldn’t help the situation either would be the wave of rumors regarding South Korea possibly banning cryptocurrencies and China increasing the restrictions they’ve already placed on them.

This pattern would go on for the year 2018 with Bitcoin, at the lowest, dropping to 5,868 USD. This slump wouldn’t last too long, however. Soon after, Bitcoin’s value would begin a slow and steady creep upwards in 2019, reaching 12,024.08 USD in June.

BTC Price from January 1, 2017, to December 30, 2019

Source: CoinGecko

Current all-time high

(2020-Present)

Many were concerned at the start of 2020 about where Bitcoin would end up, and that was before the coronavirus pandemic hit the globe. As with many things, the onset of the global pandemic had a negative impact, dropping BTC’s value to 6483.72 USD per BTC in March of that year.

Luckily for coin holders, this effect wouldn’t last long. From March onwards, Bitcoin’s value would see a rapid climb over the next few months. By December of 2020, BTC would see a value of 28,768.84 USD and by March of 2021 settle at 58,734.48 USD.

By mid-April, BTC value would exceed 63,000 USD, the highest recorded at that point. While it may look like it may have peaked at the time, the current all-time high is yet to come.

BTC would see a short but quick decline in the price range of 35,945 USD in June but would quickly recover to 47,663.02 USD in August. After a short dip, Bitcoin would then reach its current all-time high of 68,789.63 USD in November of 2021.

BTC Price from January 1, 2020, to December 21, 2021

Source: CoinGecko

The path from here

As the year comes to a close, Bitcoin’s value hovers at around 48,000 USD — a ways away from its ATH just a few weeks ago. This begs the question: what does the future hold for Bitcoin in 2022?

The life of a crypto trader is one that requires patience. Over many times in its short history, Bitcoin would find a relatively high spot, drop low, then climb even higher than before in a cycle that would confuse newbies.

But that’s the thing: as we learn more and more about cryptocurrencies, it’s becoming more apparent that pulling out your money the minute you see a dip isn’t the best move. In fact, over the last 10 years, we’ve seen that these dips are followed closely by a high-rise.

With that said, the best step for both the new and the experienced would be to make sure you’ve done your own research. It helps to be prepared after all. Do your due diligence and learn more about cryptocurrency price behavior and what you should do when things start shifting.