The Bitcoin halving, also known as “the halving”, is one of the most anticipated events in the Bitcoin world. To help you further understand what it is, let’s have a quick look at the process of acquiring today’s dominant digital coin. Bitcoin mining is the process where miners acquire BTC through digging into Bitcoin’s digital cave with specialized mining equipment as their virtual pickaxe.

Bitcoin miners are essentially guessing over and over again to be the first to guess a valid value that will enable them to add the next block. The more computer power (also known as hash) each miner contributes to the network, the greater their chances of adding a block. A block refers to a file that stores or keeps roughly 1 megabyte (MB) worth of Bitcoin transactions. As more and more transactions are verified, Bitcoin’s network also increases in size.

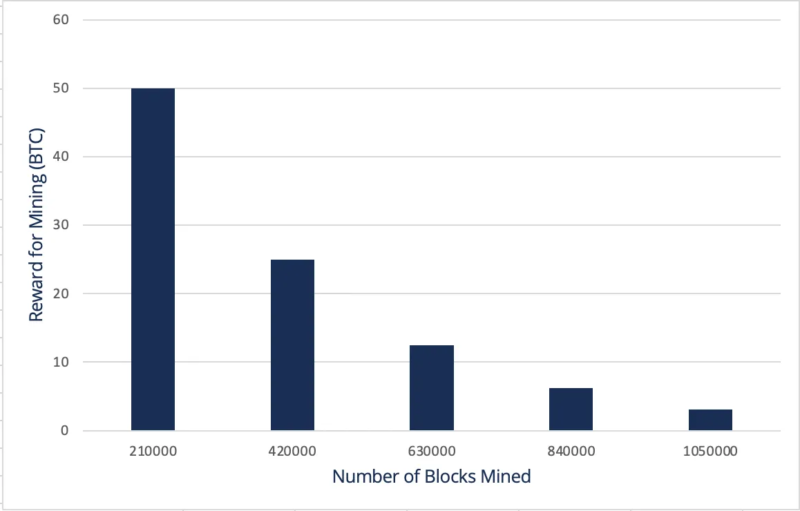

Miners who guess correctly are rewarded with newly issued Bitcoin as payment for securing the ledger with their computing power. Now, in the process called the Bitcoin halving, the rewards earned by miners fall by half after a set of 210,000 blocks is mined, or roughly every four years.

How does it work?

During the early years of BTC, the miners received 50 BTC for every verified block. After more BTC was mined in 2012, the 50 BTC reward was cut in half, leaving miners with 25 BTC per block. After the second set of 210,000 blocks were produced in 2016, the reward fell by half again, leaving miners with 12.5 BTC. The most recent Bitcoin halving happened in May 2020 and after the third set of 210,000 blocks was mined, the reward was cut in half once more and is now at 6.25 BTC per block.

Source: corporatefinanceinstitute.com

How does Bitcoin halving affect BTC’s price?

The halving has a varying impact on the price of Bitcoin. Here are the effects of the previous halvings on Bitcoin’s market price.

- First halving (2012) – The first-ever Bitcoin halving occurred on November 28, 2012. After mining the first set of 210,000 blocks, the reward was cut down from 50 BTC to 25 BTC per block. Before the halving, BTC was selling at 12 USD per coin. After a year, its market selling price reached over 960 USD.

- Second halving (2016) – After block number 420,000 was mined, the second halving took place. On July 9, 2016, Bitcoin miners started to receive 12.5 BTC per block. Before the second halving, BTC was selling at almost 665 USD, and after a year, its market value reached a booming 2,550 USD.

- Third halving (2020) – The Bitcoin halving in 2020 happened on May 11. After the third set of 210,000 blocks was mined, the miners’ rewards were cut in half to 6.25 BTC per block. On the last day of 2020, Bitcoin was selling at a soaring price of over 29,000 USD—last year’s all-time high.

- Fourth halving (2024) – The next Bitcoin halving is expected to happen in 2024 after block number 840,000 is mined. By this time, miners will receive a BTC reward of 3.125 per block.

These halvings will continue until all 21 million BTC have been mined, which should occur sometime in the year 2140.

Why does Bitcoin halving occur?

After knowing how Bitcoin halving works, you’re probably thinking, “Isn’t it unfair for miners who do all the hard work to dig in Bitcoin’s digital cave?” If you’re an avid Bitcoin fan and user, you probably know that its mysterious and pseudonymous developer, Satoshi Nakamoto, created BTC with a finite supply of 21 million coins.

As of July 5, 2022, 90.88% of BTC’s total supply has already been produced. This means that only 1,913,468.73 BTC are left to be mined. However, there’s no guarantee that all the 19,086,317.18 BTC produced are circulating in the markets today. In fact, a report from the New York Times mentioned that around 20% or billions of dollars worth of BTC is in lost or stranded wallets.

When all 21 million Bitcoins are mined, the miners will no longer receive block rewards. They can only make money from fees for every transaction they confirm. While it is true that the miners’ rewards fall by half when halving occurs, Bitcoin becomes more scarce because of its limited supply and the value of one BTC continues to skyrocket over time. The surge in Bitcoin’s price is also what motivates miners to continue digging.

What are the effects of BTC halving?

There are different effects of Bitcoin halving—from BTC’s market price on miners’ rewards and traders’ impressions towards the market movement. Here are some of the notable advantages and drawbacks of this event.

⚒️ On miners

Bitcoin mining is known as one of the most effective ways of acquiring fractions of Bitcoin. On the flip side, running a mining operation can be really expensive, depending on whether you’re a solo miner or part of a mining pool. Either way, you’ll need high-powered mining equipment and specialized software that can cater to the tedious and costly processes of acquiring fractions of Bitcoin.

For some miners, the sudden decline in mining rewards may sound less profitable. Because of the massive amount of investment they made in the powerful mining machines they’ve built, the diminishing amounts of rewards per block might not be enough to cover their mining operation’s expenses. However, it’s also important to note that this might not be the case all the time for every miner because of Bitcoin’s highly volatile nature.

📊 On traders

While some miners don’t always love the idea of Bitcoin halving, this event is very much anticipated by Bitcoin enthusiasts, traders, and investors. Why? Because in this period in the Bitcoin world, the number of coins generated by miners is reduced. This means that the limited number of acquired coins paves the way for BTC’s price to soar if the market demand increases. The higher demand and the limited supply of this digital asset can bring more market opportunities for traders to sell BTC at higher prices.

While we saw this promising trend from the first to the recent Bitcoin halving events, it’s still important to keep in mind that this volatile asset can appreciate or depreciate swiftly—depending on the market movements that may happen.

📈 On BTC’s price

We mentioned earlier that Bitcoin halving could push up its market price. However, this doesn’t always happen and we aren’t a hundred percent sure about how high the price will be. There might be a towering price after days, months, or even years, and there might also be price dips in between.

Additionally, will there be more interested folks outside the Bitcoin world after the halving? Will there be another bull run? Will there be new traders in the market? These are just some of the many questions that might come to one’s mind, but we’ll just have to wait to find out.

Can you make extra cash from Bitcoin halving?

Bitcoin is known for its wild price fluctuations. So whether it’s after halving or not, it’s not impossible to make money out of it. You can try keeping an eye on BTC’s price movements for a week or month and decide when is the best time for you to buy or sell if you’re up to trading Bitcoin.

Just always keep in mind that you need a reliable Bitcoin wallet and platform before you engage in any trading activity. If you want to try your hand at Bitcoin trading, you can create an account on Paxful to get started. You’ll also receive a free Bitcoin wallet where you can manage and keep track of your funds anytime and anywhere you are—easy, right?

Is Bitcoin halving a bad thing or a good thing?

We’ve learned from the things we’ve discussed earlier that the Bitcoin halving has varying effects on its market price, miners, traders, and investors—it has its fair share of benefits and drawbacks. Like other assets and valuable commodities, Bitcoin’s price comes down to supply and demand. However, for miners who receive a diminishing amount of rewards roughly every four years, it might not always be as motivating and enticing as the reward of 50 BTC per block that they could earn before the first halving.

But after more than a decade of Bitcoin’s existence in the market, its rising popularity and worldwide adoption undeniably push its price even further. So is this Bitcoin halving cycle a good or bad thing? We’ll leave the answer up to you.

*The content of this article is for informational purposes only. The opinions expressed here are not meant to be taken as financial, investment, or any other advice, nor do they express the opinion of Paxful.