At this point in Bitcoin’s (BTC) timeline, its popularity has grown to unprecedented heights. It has become a worldwide phenomenon, especially now that it recently hit its all-time high.

Don’t get us wrong, we love how popular it’s become. However, as more people use the network, transactions tend to slow down and the fees can sometimes become a bit more costly. This is mainly due to the limited 1MB block size that Bitcoin has. This issue of BTC’s scalability—particularly its ability to change in size—has divided some of the crypto community.

How did they fix it?

When discussions arose about how to fix the scalability issue, two main ideas were floating around. Think of yourself as Bitcoin’s official accountant, tasked to record every BTC transaction ever. All you’re given to do your job is a single piece of paper and a pen. Remember, you’ll need to take down both the sending and receiving wallet address and the signatures of each transaction. That’s a lot of information to fit on a piece of paper.

Get more paper!

The first idea was to change the format of blocks. One camp thought: well, why not have two sheets of paper? One to write the addresses and then another to write the signatures?

In BTC terms, they wanted to keep the 1MB block size but process transactions on off-chain settlement layers. Basically, they tried to redirect Bitcoin from being electronic cash into a collectible settlement layer.

Get a bigger piece of paper!

The second idea was to increase the block size limit. Another camp thought: what if we got a piece of paper that was twice as big as our original sheet of paper? And then we can just keep getting bigger paper as Bitcoin becomes more popular!

Switching back to BTC terms, this camp wanted to double the block size from 1MB to 2MB—and then keep increasing that size as it gets more popular.

Which idea won?

Despite the first idea (changing the format of blocks) getting the majority of the votes, the Bitcoin Core team—those in charge of developing and maintaining the algorithm that powers Bitcoin—blocked it from happening. A hard fork happened and this resulted in Bitcoin Cash that we know today.

What is Bitcoin Cash (BCH)?

Bitcoin Cash was officially released in August 2017. Since it’s a hard fork of Bitcoin, it kept a lot of its traits. The technology is nearly identical to BTC’s. They even have the same supply cap of 21 million coins, just like its predecessor. In fact, anyone who was holding BTC at the time of the fork was lucky enough to receive the same amount in Bitcoin Cash.

The primary purpose of BCH is to be used as a payment system, meaning people could send and receive funds just like its older brother, BTC. However, since it has a larger block size, Bitcoin Cash allows faster and cheaper transactions.

Unfortunately, because BCH is newer, not many merchants and businesses accept it as a payment method just yet. As it gets more popular, however, it can forge its own path moving forward.

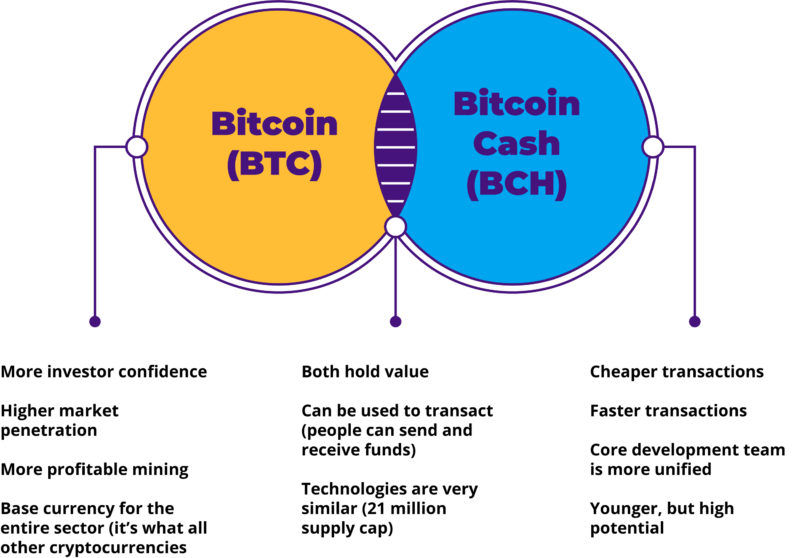

On the surface, Bitcoin and Bitcoin Cash are very similar. They both hold value, both use (more or less) the same technology, and both can be used to send and receive funds. However, as we dive deeper, you’ll see that there are a lot of distinguishing factors.

Let’s start with the most obvious: price. Recently, Bitcoin hit its all-time high value of 19,857.03 USD per BTC towards the end of November 2020. Bitcoin Cash, on the other hand, is much younger and is still finding its place in the crypto space. At the time of writing, BCH’s price is at 288.44 USD.

In general, BCH doesn’t have as much investor confidence as BTC. This is because Bitcoin is basically the base currency of this space—it has more trading pairs, it’s what all other cryptos trade against, and it has dominated the sector for almost 12 years now. Also, BCH is nowhere near as profitable as BTC mining.

However, by now, we know that it isn’t always about the money. This is where the difference between Bitcoin and Bitcoin Cash is the most apparent. BCH has a lot of advantages to consider. As mentioned before, BCH is faster and cheaper compared to BTC. Essentially, this means that more people can transact on the blockchain at any given time.

The development team is also quick to work on solutions that make the blockchain more scalable. Compared to BTC’s dev team, BCH’s team is more unified. Because BTC’s core development team lacks leadership and is more divided than BCH’s, scaling solutions are more challenging to agree on.

The future of Bitcoin Cash

At the time of writing, Bitcoin Cash is sitting pretty at the number 6 spot among all cryptocurrencies, according to CoinMarketCap. As it continues to grow, it’ll start making more noise within the space and people will notice.

Many people believe that these two cryptos should be pitting one against the other. In some aspects, yes, the two have their own set of advantages against the other. However, that doesn’t mean these two can’t coexist. You could use BCH as a transaction tool while you keep BTC as a store of value. Both are really excellent options for investors to consider—so make sure you don’t sleep on either coin!

On a separate note, you can exchange your Bitcoin for Bitcoin Cash on Paxful and vice versa.