Five trillion USD—this is the Indian government’s gross domestic product (GDP) target by 2024. This exceptionally huge amount is thrice as much as Apple’s current market capitalization. For the nation to achieve this seemingly “unimaginably ambitious” figure, it has to take up a system or technology that will aid in boosting its economic growth.

In the fintech sector, there’s an exceptional innovation known as blockchain technology. It’s been exhibiting tons of great uses in a lot of countries and industries, which makes it an excellent technology suited to hike up India’s economy.

Before we dig deeper into the game-changing uses of blockchain technology in India, let’s quickly go over what blockchain is.

A quick look at blockchain technology

In the world of crypto, blockchain is referred to as the powerful mind behind bitcoin (BTC)—the most dominant cryptocurrency since its creation. It’s a technology where the block or digital information or data are recorded in a public network or the chain.

Blockchain technology is used in various industries today, such as government, automotive, insurance, media and entertainment, travel and transportation, banking and financial services, and a lot more.

Let’s take public records and other confidential data, for example. Using blockchain technology, the government and other industries like healthcare and insurance are able to record all the information digitally and accurately. Frauds and other possible errors from paper-based processes are minimized through blockchain-based data tracking and recording.

The practical, clear-cut applications of blockchain in real-world industries prove that this innovative technology can be carried out in developing countries like India.

India’s current economic situation

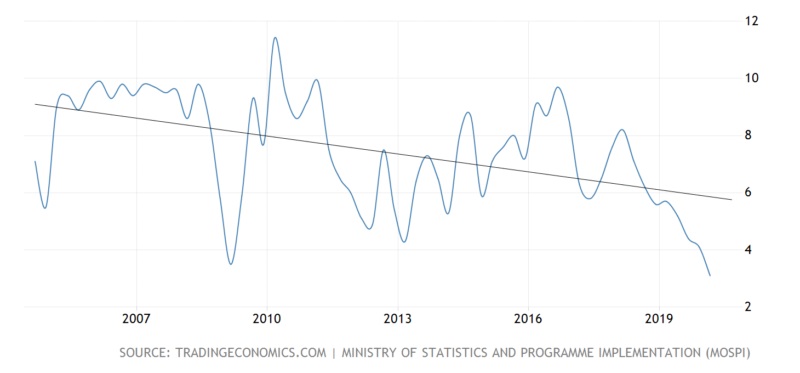

During the first quarter of 2020, the Indian economy expanded 3.1 percent. While the country surpassed the market forecasts of 2.1 percent rise, it is still viewed as the slowest-moving annual GDP growth since 2004.

A lot of factors have affected the sudden downturn in India’s GDP annual growth rate. These include changes in imports and exports and in private spending and inventories. There are also some cut backs in production and manufacturing systems, and operation adjustments in hotels and transportation, among others.

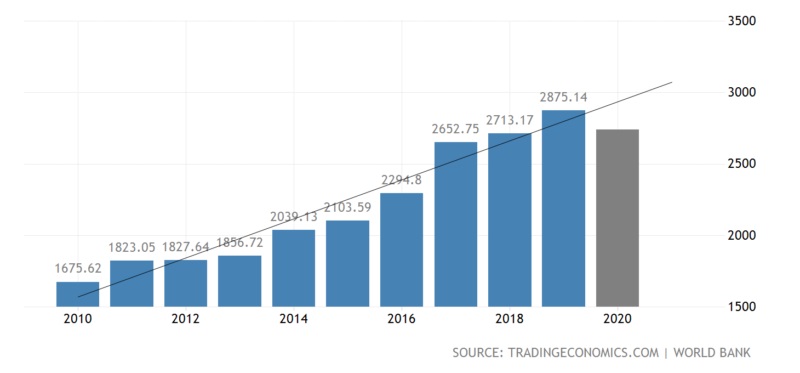

On the other hand, if you take a look at India’s GDP in the graph below, you can see that the country’s been doing well. The World Bank’s data and Trading Economic’s projections showed that in 2019, the country’s GDP reached 2875.14 billion USD—a value representing 2.39 percent of the global economy.

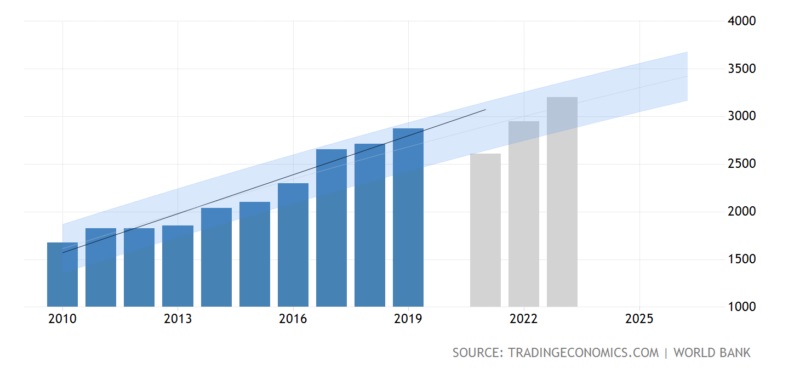

Forecasts from Trading Economics and analysts state that by the end of this year, India’s GDP is expected to hit 2610.00 billion USD and is predicted to sweep upward at around 2950.00 billion USD and 3200.00 billion USD in 2021 and 2022, respectively.

You’re probably asking yourself how India can achieve its five trillion USD GDP goal given the current and forecasted numbers, so to put your mind at ease, let’s see how blockchain can help the nation hit the target.

Potential applications of blockchain in India

There are many ways on how blockchain can be India’s game-changer. Let’s take a look at some.

1. Financial inclusion through cryptocurrencies

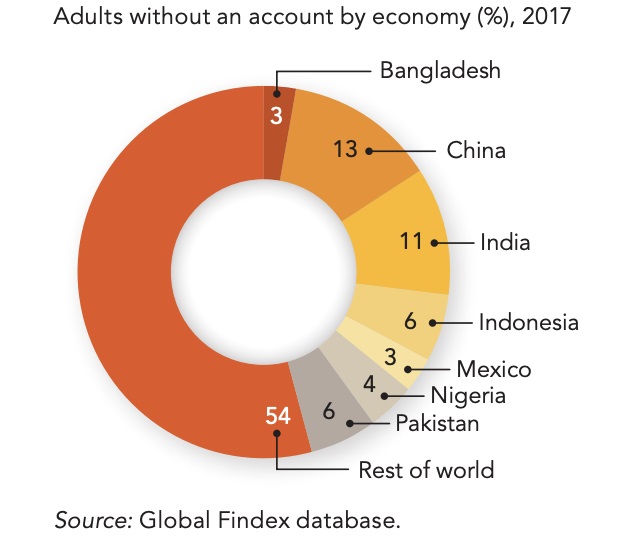

The World Bank Group’s 2017 Global Findex Database noted that 1.7 billion adults across the globe have no bank accounts. India is known to have high percentages of account ownership, however, its share in the unbanked count is also striking.

India follows China’s lead by having 190 million people without bank accounts or 11 percent of the world’s total unbanked population.

On the flip side, 69 percent of adults in India have mobile phones and access to the Internet. Blockchain technology and mobile accessibility combined can bring accessible and far-reaching financial services from institutions and providers around the world.

One good case in point is bitcoin (BTC), which is within a user’s reach through mobile applications and cryptocurrency exchanges on the Internet. Through blockchain technology, the Indian population can easily and quickly make payments both locally and internationally.

The unbanked and underbanked population in India can also have access to a wide range of monetary transactions, without worrying whether there’s a bank or financial service provider in their area, or if they’ll ever get approved of an account of their own.

2. Accessible and efficient cross-border money transfers

India is known as the “highest recipient of remittances” in 2018 with 79 billion USD, according to the World Bank. Aside from allowing efficient and accessible payments, blockchain can also provide seamless and instant money transfers by enabling blockchain-based platforms, as they are accessible through personal devices like laptops and smartphones.

3. Low-cost transaction fees

Often, remittance charges vary depending on the amount to be sent and the location where the money will be sent. Most of the time, the fees depend on which financial institutions and services providers you decide to go to for your transaction.

With blockchain technology, there’s no need to think too much about transaction amounts, location, and purpose of money transfer. Since this innovation works digitally, a lot of manual processes have been cut off, which makes way for simplified and cheap money transfers.

4. Improved data recording and traceability

For decades, important records were written down on papers that are likely stacked in a secure room or high-security storage cabinets. This conventional way of storing data—which is evident in the banking and financial sectors even up to this day—can yield many forms of inconvenience.

With blockchain technology, this record-keeping system is digitized using distributed ledger technology (DLT), which records asset transactions and other important information in multiple places at the same time. This feature of DLT leads to easy data retrieval and faster transaction processing.

One good case to note is the data recording and transaction processing of valuable assets like gold. India is one of the world’s largest markets for gold, and blockchain technology is an excellent solution that can provide more secure, efficient, and transparent supply tracking of this valuable asset.

Suppliers and consumers will be able to learn the asset’s origin and destination through the robust record processes of blockchain technology. This can help identify illicitly acquired gold and other precious metals and prevent them from entering the supply chain before they get distributed to the market. Aside from that, blockchain technology can also help manage smaller amounts of gold, which can increase its market liquidity levels.

5. More income-generating opportunities

Blockchain technology in India can bring a lot of money-making opportunities. Arbitrage trading where you turn your INR to BTC or vice versa can bring in an income of various amounts. HODLing is another income-generating opportunity wherein investors buy Bitcoin, hold it regardless of price, and sell it when the market is bullish—or when prices are soaring or expected to shoot up.

Many traders will check bitcoin prices in INR before entering the crypto market to give them an idea of when to buy and sell BTC.

Blockchain adoption in India

Adopting blockchain technology in India and other parts of the world may not be an easy thing to do. Even so, India has slowly started to embrace this innovative technology not only in the finance and technology field but also in other industries.

Blockchain has more to offer than just making high-speed and reliable payment processes. So, it’ll be no surprise that we’ll catch sight of a rising bar of countries taking on this innovation soon!