In 2021, non-fungible tokens, or NFTs burst onto the scene and gained a ton of popularity seemingly overnight. Now, everyone’s talking about them and adoption is growing faster than ever.

NFTs can be a great avenue for investors, artists, musicians, collectors, and more. However, there are always risks involved. So that you don’t fall victim to schemes like these, we’re going to be talking about one specific risk: wash trading.

What is wash trading?

Traditionally speaking, wash trading is a process in which a trader buys and sells an asset themselves solely for the purpose of feeding fake or misleading information to the market. Although this may include a third party, this process will often have a single trader acting as both the buyer and the seller.

In the NFT space, someone acting as both could make an NFT’s price appear high when, in fact, the money the buyer paid is going to a wallet they also control.

Let’s say there’s an investor who put 100,000 USD in Ethereum (ETH). If they were to mint an NFT and then sell it to themselves for all the ETH that they had, the NFT’s value would appear to be worth that much according to its trade history. Even if they were to sell the NFT at that price point with a 50% discount, they’d still be netting 50,000 USD in the process.

Examples of wash trading

One of the biggest examples of wash trading was the LIBOR Scandal that first surfaced in 2012. Bankers from several major financial institutions conspired with one another to manipulate the London Interbank Offered Rate (LIBOR), which is a benchmark interest rate that global banks use in the international interbank market when they deal with short-term loans. This scheme left many big financial institutions implicated and caused contracts—such as mortgages, derivative trades, corporate fundraising—to be misplaced.

Wash trading with NFTs

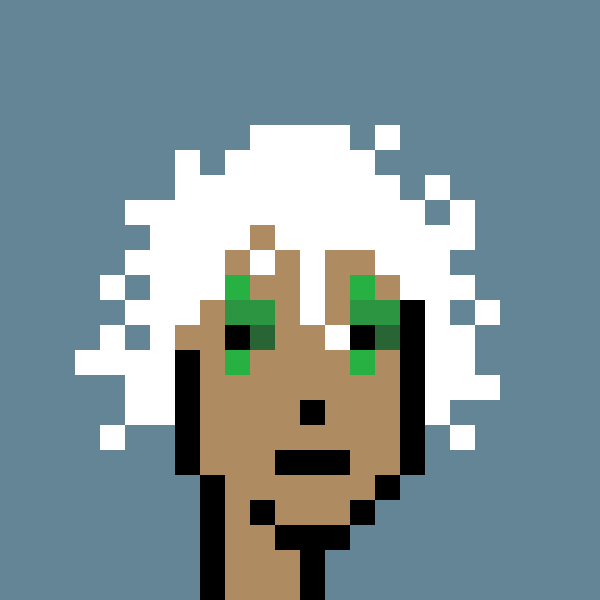

In the NFT space, one of the bigger examples of wash trading includes a CryptoPunk. Popularized by Larva Labs, CryptoPunks is a collection of 10,000 unique and pixelated artworks built on the Ethereum blockchain. In fact, they became so popular that a few of them rank high in the list of most expensive NFTs ever sold.

However, with the case of CryptoPunk 9998, there seemed to be an evident case of wash trading. Sold on October 28, 2021, for 124,457 ETH (around 532 million USD at the time), the funds used to buy this NFT were transferred back to the buyer. It was then re-listed on an NFT marketplace for 250,000 ETH. Just to give you an idea of how much it affected the value on the surface level, this specific CryptoPunk was selling for 300,000-400,000 USD before the wash trading incident.

CryptoPunk 9998. Image c/o @cryptopunksbot on Twitter

Staying safe from NFT wash trading

Although it’s mostly only platforms and marketplaces that can implement software to prevent this from happening, there are a couple of things you can do to not fall victim to a wash trading scheme.

- Do your research

When it comes to NFT projects, it’s important to know what people are saying about them. The discussions are mostly held on Discord channels, so if you ever have suspicions about an NFT being a wash trading scheme, people in the community would be talking about it. - Look at past trades

If you want to do the digging yourself, like people did for CryptoPunk 9998, you can always look at the past transactions of the NFT and see if you find a pattern. If there are similar wallet addresses just sending money to one another, it may be a wash trading scheme. - If it’s too good to be true, it probably is

The point of these wash trading schemes is to create hype around a specific NFT. Before you throw down a significant amount of money on a piece of digital art, make sure that your judgment isn’t clouded by the hype surrounding it. Remember to take a step back, breathe, and actually think about the purchase.

New isn’t always better

Although they’ve been around for a couple of years now, NFTs have only experienced a significant surge in popularity last year. Yes, it’s gained many new traders but as with all new technology, risks are always higher at the beginning.

Take Bitcoin as an example. It’s been around for over 13 years now and has been tried and tested. Not only is it a great investment tool, but it has also developed real-use cases such as cheaper remittances, more efficient payments, wealth preservation, and even meaningful philanthropy.

Although it isn’t necessarily fair to compare the two—after all, one is much older than the other—it just shows that both spaces are still growing. Just be sure to know what you’re getting into before throwing any money down.

When it comes to any sort of investment, there will always be risk—the trick is to minimize it as much as possible. That’s where research comes in, since it’s so important to familiarize yourself with what you’re getting into before putting any money on the table.