Before exchanges and peer-to-peer marketplaces began to pop up, Bitcoin mining was the only way for people to get their hands on BTC. Since then, due to various factors that will be discussed later on, Bitcoin mining difficulty has only gone up while mining profitability has gone down.

Before determining if Bitcoin mining is still profitable, let’s discuss Bitcoin mining first. Mining refers to the process of adding and verifying transactions onto the blockchain—Bitcoin’s very own public ledger. Nodes, referring to any computer that connects to the Bitcoin network, work to solve complicated equations and add blocks to the blockchain using the Proof-of-Work consensus algorithm—the system used to validate all transactions.

Simply put, miners will use high-powered equipment to verify transactions and in turn, are rewarded with new Bitcoin—also known as the block reward. Because of the Bitcoin Halving, the amount of BTC rewarded to these miners will vary.

A quick rundown on Bitcoin halving

When Bitcoin was created in 2009, the reward for successfully adding a block to the blockchain was set at 50 BTC. However, Bitcoin’s blockchain was also programmed so that the block reward would be cut in half every 210,000 blocks. This is the Bitcoin Halving and it was coded into Bitcoin making it a deflationary currency. Satoshi Nakamoto, Bitcoin’s anonymous creator, believed that if too many coins were created too quickly (and if there was an unlimited supply of Bitcoin, which isn’t the case), BTC would be devalued by the sheer number of coins in circulation.

With the average rate of six blocks being mined per hour, a Bitcoin Halving will happen roughly every four years with the first-ever Bitcoin Halving happening in 2012. Block 210,000 rewarded its miners with 50 BTC. However, block 210,001 saw its block reward dropping to 25 BTC. The following Bitcoin Halvings would then cut that reward to 12.5 BTC in 2016 and then 6.25 in 2020. If you want to keep track of these Halvings, there are many websites you can use like CoinMarketCap’s real-time tracker.

This pattern of cutting block rewards will happen until the reward is eventually reduced to zero, which is estimated to occur in 2140. When that happens, miners will likely be rewarded in transaction fees instead of new BTC.

How does the Bitcoin Halving affect mining?

It can be alarming to see that the reward for mining Bitcoin is getting smaller with each Halving. However, one thing to take into account is that when the block reward was higher, the value of Bitcoin wasn’t as high as it is today. When people started mining Bitcoin, the space wasn’t as competitive as it is today and everyone was basically using laptops and desktop computers to mine.

However, with the development of Application-Specific Integrated Circuit (ASIC) miners, the technological gap widened. Through these equipment, mining capabilities increased exponentially and made previous mining equipment obsolete. These mining rigs also increased the hash rate—the measure of a miner’s computational power—of Bitcoin, making the network much healthier as a whole. Unfortunately, because of the widened gap, expenses on equipment were raised. This meant that mining difficulty for individuals increased—especially when industrial Bitcoin mining centers with extremely powerful machines began to pop up.

It was ultimately at that point that people began to question the profitability of mining: with Bitcoin Halvings, larger mining operations to compete with, and added expenses on equipment, is Bitcoin mining still profitable?

Factors you should consider before mining Bitcoin

If you’re thinking about getting into Bitcoin mining, there are a couple of things you’ll need to consider before you start. Remember, mining difficulty only keeps increasing, so the more you know about it, the more you can make an informed decision on taking the leap.

The process of Bitcoin mining is a little complicated

On the blockchain, transaction validations are measured in hashes per second. With the way the network is designed, only a certain number of coins is produced per second—meaning that the more active miners there are, the more difficult it can be to mine. It was designed this way so that BTC’s distribution remains static.

You’ll have fierce competition

As mentioned earlier, the development of ASIC miners allowed larger mining companies to enter the playing field. This means that if you don’t join a mining pool (and split the reward with other miners), you’ll have a difficult time competing with the larger operations.

Mining equipment uses a lot of power

Although electricity costs will differ depending on where you live, you’ll need to take into account that you need a lot of electricity to power the mining rigs and keep their temperature in check. A location with a cold climate and surplus electricity is the ideal location to mine Bitcoin. Surplus electricity tends to be cheap while the cold weather will eliminate, or at least minimize, the power consumption of the cooling system of the mining rigs.

Tools are expensive

There are two main routes you can take when it comes to equipment: a GPU mining rig or an ASIC miner. GPU mining rigs use graphics cards, similar to the ones you use on your personal computer, to mine Bitcoin and other cryptocurrencies. Although they’re more affordable, GPU mining rigs are nowhere near as fast as ASIC miners, which are dedicated machines that were made for the sole purpose of mining Bitcoin. These miners can set you back a few hundred dollars up to around 10,000 USD (if you’re looking for a more powerful chip).

Calculating Bitcoin mining profitability

To give you a better understanding of how much it actually costs to set up a Bitcoin mining operation, let’s use a real-world example of mining profitability.

Let’s say that you’re living in the United States and are thinking about buying an ASIC miner to start up your personal mining operation. Mining solo is definitely going to be the more costly option, but for your efforts, you’re going to earn the exclusive reward.

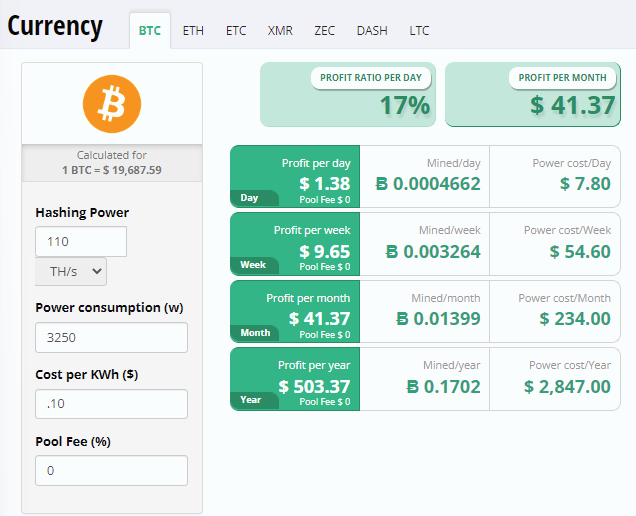

For this example, the ASIC miner we’re going with is the Antminer S19J Pro 100 TH/s—a relatively powerful chip. At the time of writing, this miner is priced at around 4,300 USD and has a 3250w power consumption. If we input the cost per KWh—which, in the US, is around 0.10 USD—into a mining calculator like CryptoCompare, we can see how much we can possibly profit:

Remember: this isn’t even considering the cooling, property (i.e. rent for wherever you’re storing your machines), Internet, and other miscellaneous costs, so you’ll need to be comfortable with a 41 USD monthly profit per miner. If you want to touch the average living standards in, let’s say, California (which has a median income of around 32,000 USD), you’ll need multiple ASIC miners—so it’s safe to say that getting your operation started will cost you a lot.

Although these prices are based on the cost of living in the US, your operation might be a little cheaper if you live in a mining-friendly country.

Mining isn’t the only way to get Bitcoin

The answer to mining’s profitability question isn’t as simple as everyone wants it to be. In most cases, the ones who mine at home and compete with the larger mining companies will struggle to recoup the expenses of mining hardware and electricity consumption. If innovations are made to ASIC miners and your operation is paired with cheap and sustainable power, the situation can improve and average miners may be able to see more profitability again.

Although Bitcoin’s profitability may be questionable for some, it’s important to note that mining is no longer the only way to get your hands on BTC. Exchanges and peer-to-peer marketplaces like Paxful are more popular and people can get BTC in hundreds of ways—e-wallets, bank transfers, credit/debit cards, gift cards, and more. If you’re still a little iffy about getting into mining, you can try trading with as little as 10 USD and see if you like that route a little better.

*The content of this article is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. You should carry out your own independent verification of facts and data, do your own research, and may want to seek professional advice before making any decisions.

* This article does not make any implications, warranties, promises, representations, or guarantees whatsoever to you about your prospects or earnings, or that you will earn any money, with respect to Bitcoin mining.