Disclaimer: This is an Op-Ed by a Paxful Employee, the opinions expressed in this article should in no way be interpreted as legal, investment, financial, or other advice.

For long, bitcoin was considered to be its own asset class that does not correlate with other asset classes and in its ecosystem, moved freely, albeit with some volatility. This whole notion was put into question when the bitcoin price dropped sharply from 7,938 USD on March 11 to 4,857 USD on March 12, almost immediately after Donald Trump announced a travel ban against Europeans.

Vishal Chawla, in his article Why is Bitcoin and Stock Market Correlated at this Moment mentions that:

“Market emotion can perform a vital function in circumstances when both more conventional assets like stocks and more new digital assets or cryptocurrencies exhibit meaningful similarities. These situations are often driven by events that drive people to go in aggregate, crowding to or away from individual kinds of assets.”

His statements are backed by a rolling correlation graph between the S&P 500, a stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the United States, and the performance of bitcoin.

Amidst the coronavirus crisis, the correlation has hit the highest in 2 years after the exponential rise in the cryptocurrency market followed by a steady decline in the latter half of 2017 and early 2018.

With #Bitcoin’s correlation with the #SP500 currently at a 2-year high, we have just released an in-depth research article into what we can collectively learn in regard to this unprecendented downturn among both markets.https://t.co/LZnfqYHdzS

1) #BTC‘s correlation with the pic.twitter.com/RRLtaU5UVY— Santiment (@santimentfeed) March 20, 2020

Santiment made an interesting observation that the correlation between these two rises when there is a significant drop in the price of bitcoin. However, when the price of bitcoin rises, the correlation tends to be lower.

From their insights, they were bold enough to suggest that bitcoin will recover faster than stocks, as bitcoin generally stops moving in the direction of S&P when it is gaining momentum.

Jesse Powel, co-founder and CEO of Kraken, whose company is still hiring staff with a variety of skill sets despite the coronavirus crisis, mentioned the spike in new registrations and sign-ups on the platform after the outbreak of coronavirus. In his interview with Forbes, Powel says that there is some correlation between bitcoin and the traditional market. He adds that there is a common denominator between these markets and that are retail investors whom he labels as being “basically gamblers.”

“They make their trades on a whim, they follow the markets and no matter what they are investing in, they are buying in their way up and they are panic-selling when something goes wrong,” adds Powel.

There can be several reasons behind the price drop, but one of them (even possibly a significant factor) can be this common denominator. Powel attributes this drop to people “deleveraging and selling some of their assets (in bitcoin) to cover other assets in the equity market.”

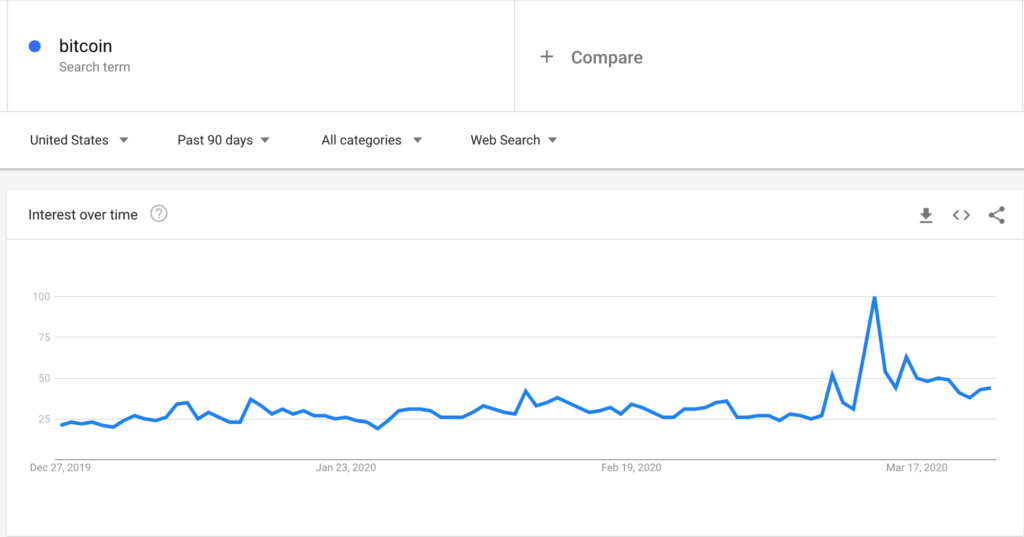

Despite the big drop in the second week of March, bitcoin has seen a more or less steady recovery and the interest around bitcoin has become the highest in over 6 months. Paxful also had a record number of registrations in history in the month of March.

Corona Relief Economic Packages

Many governments have come up with their own stimulus packages to help the economy. These governments are printing unprecedented amounts of money to avert the crisis, but “Helicopter Money,” though it may provide short-term relief, will end up causing adverse effects according to Mati Greenspan, founder of financial advisory firm Quantum Economics.

“At the moment, what we’re seeing from the market is an unprecedented move to cash. Everyone is liquidating everything they can. Once the dust settles, and we start to see how the end of the ‘coronacrisis’ might look, people are going to be sitting on way too much fiat,” concludes Greenspan.

There has been a sizable amount of criticism against this decision and the long-term economic risk can easily outweigh the short-term crisis aversions. Increasing the supply of fiat comes with its own qualms. This article about the problems of printing money explains that simply printing more money without creating something tangible with similar value can create a fall in the value of saving like inflated menu prices for everyday items, along with uncertainty and confusion that follows.

These are the times when bitcoin and cryptocurrencies often shine for their transparent nature and capped supply. Bitcoin’s utility as a medium for wealth preservation is often overlooked and under-discussed. Since bitcoin in large parts of its history has not correlated with other asset classes, investors may be lured to invest in bitcoin as a medium to protect the value of their money until the economies become stable.

One of the most important imminent events that have slipped under the radar amidst the chaos caused by the outbreak of COVID-19 is the next bitcoin halving. The third bitcoin halving is set to happen around the 18th of May this year. The analysis of the last two halvings suggests that the price of bitcoin usually goes on an upward trajectory as bitcoin starts getting more and more scarce.

If the demand for bitcoin stays consistent, the halving has a lot of potential to trigger another bull run for bitcoin. When Satoshi envisioned bitcoin, he wanted to bring economic power back to the people and the performance of bitcoin in 2020 would certainly be a litmus test to the prowess of bitcoin.